Sometimes, I look out at the Rockies and think about what it means to truly settle somewhere. To build a life, raise a family, and then, eventually, to imagine a peaceful retirement. I remember my own grandmother, a strong woman who worked tirelessly her whole life, always dreaming of a time when she could simply enjoy the sunshine and spend time with her grandchildren. But she worried. She worried about money, about healthcare, about being a burden. Those worries stayed with her, even as she enjoyed those precious moments.

That's why I put together this list of books. It’s not about getting rich quick or complicated financial jargon. It’s about feeling secure, knowing you have a plan, and being able to face the future – whether it’s planning for healthcare in Denver, thinking about long-term care, or simply dreaming of a comfortable retirement – with confidence and peace of mind. This is for Colorado families who want to feel prepared, not overwhelmed, and ready to truly enjoy the next chapter. Let’s explore these resources together and build a brighter future, one page at a time.

The Only Investment Guide You'll Ever Need: Revised Edition

This book has been a trusted resource for millions of Americans when it comes to managing their finances and investing in their futures. The author, Andrew Tobias, has a way of making complex financial concepts easy to understand and accessible to everyone. He covers a wide range of topics, from the impact of COVID-19 on the economy to the rise of cryptocurrency and NFTs. What I love about this book is the way it breaks down intimidating financial jargon into bite-sized, actionable tips that anyone can follow. I remember when I first started reading it, I was struck by how relatable the author's advice was - he talks about the importance of starting small, being patient, and not being afraid to ask for help when you need it. The book also offers priceless advice on how to prepare for retirement and make the most of your savings. One of the things that struck me was the author's emphasis on the need to be informed and educated when it comes to personal finance. He reminds us that investing is not just about making money, but also about feeling secure and in control of our financial lives. With this book, Andrew Tobias has created a comprehensive and trustworthy resource that I would highly recommend to anyone looking to take control of their finances.

Discover this book on Amazon (affiliate link)

Saving for Retirement without Living Like a Pauper or Winning the Lottery: Retirement Planning Made Easy

As someone who has spent years helping people understand personal finance, I have to say that this book is a game-changer. The author, Gail MarksJarvis, has taken the complexity of retirement planning and broken it down into simple, easy-to-understand steps. She's written this book based on responses to questions from over 20,000 readers of her personal finance columns, so you can trust that she's coming from a place of real-world experience.

What I love about this book is that it's not just about saving money, but also about understanding how to invest it. MarksJarvis explains how to harness the power of the stock market, how to pick the right mutual funds, and how to keep debt from holding you back. She also addresses the new 2006 pension laws and provides clear guidance on how to navigate the often-confusing world of retirement planning.

One of the things that struck me about this book is how accessible it is. MarksJarvis eliminates a lot of the jargon and confusion that can come with personal finance, and provides clear, step-by-step instructions on how to get started. She also emphasizes the importance of starting early, and provides practical advice on how to make the most of even small amounts of money.

What I think is most impressive about this book is the sense of hope and empowerment it provides. MarksJarvis is clear that anyone can retire comfortably, without having to live on a tight budget or rely on luck. With her guidance, you can take control of your finances and start building towards a secure future. Whether you're just starting out or you're already behind on your retirement savings, this book is a must-read. It's a comprehensive guide that will provide you with the tools and knowledge you need to make informed decisions about your finances.

Discover this book on Amazon (affiliate link)

What Color Is Your Parachute? for Retirement: Planning Now for the Life You Want by Richard N. Bolles (2007-05-01)

This book is a comprehensive guide to help individuals plan for a fulfilling retirement. Richard N. Bolles, a renowned expert in the field, has crafted a thoughtful and engaging book that encourages readers to reflect on their values, passions, and long-term goals. By following the book's practical exercises and prompts, readers can gain a deeper understanding of what truly matters to them and create a personalized plan for a life of purpose and happiness. I recall a conversation I had with a friend who, having recently retired, was struggling to find meaning in her daily routine. With the guidance of this book, she was able to identify her true passions and create a fulfilling schedule that brought her joy and satisfaction. The book's emphasis on self-analysis and personal growth resonates deeply with readers, making it an invaluable resource for anyone seeking to make the most of their golden years. Bolles' easy-to-follow format and inclusive approach make the book accessible to a wide range of readers, from recent retirees to those still in the midst of their careers.

Discover this book on Amazon (affiliate link)

The Great Money Reset: Change Your Work, Change Your Wealth, Change Your Life

The book takes a deep look at how the current economic climate is forcing people to re-evaluate their lives and make big changes. The author, Jill Schlesinger, shares her expertise on how to navigate this new landscape and create the life you truly want. She notes that the pandemic has led to a sense of uncertainty, and many people are wondering how far they should go to make a change. The book offers a roadmap for these changes, providing 10 practical steps to help you achieve your goals. One of the main questions it addresses is whether quitting your job is a good idea or a mistake. The author also explores the importance of making lifestyle sacrifices and understanding the tax and investment moves you can make to secure your future. The book is all about empowerment, teaching you how to break free from your current reality and thrive in an uncertain world. Jill's approach is clear, witty, and honest, making the book an engaging read for anyone looking to make a change.

Discover this book on Amazon (affiliate link)

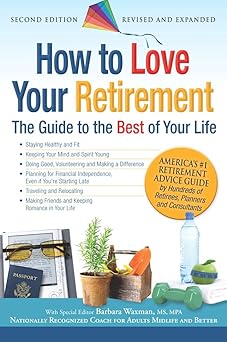

How to Love Your Retirement: The Guide to the Best of Your Life (Hundreds of Heads Survival Guides)

As a world-famous book club organizer, I recently had the pleasure of reading a book that has left me feeling inspired, motivated, and eager to share its wisdom with others. This remarkable guide is a treasure trove of stories, advice, and experiences from hundreds of retirees who have successfully navigated the transition to their golden years. With a dash of humor and wit, these individuals share their insights on everything from finding the perfect retirement timing to staying fit and active, and even learning to live with one's spouse 24/7. What struck me most about this book was the emphasis on living life to the fullest, and the idea that retirement is not just a phase, but an opportunity to reinvent oneself, pursue long-held passions, and cultivate meaningful relationships. I was particularly touched by the heartwarming stories of retirees who have found joy in travel, learning new skills, and becoming the best grandparents they can be. The author's tone is approachable, relatable, and reassuring, making this book an invaluable resource for anyone approaching or already in retirement. Whether you're looking to make the most of your retirement years or simply seeking inspiration to live life more fully, this book has something to offer. Its uplifting message and inspiring stories are sure to resonate with anyone who has ever wondered how to make the most of their golden years.

Discover this book on Amazon (affiliate link)