I was working so hard, chasing what I thought would make me happy – a bigger paycheck, a fancier apartment. But it felt…empty. Like running on a treadmill. It wasn't until I started to really understand money, not just how to earn it, but how it works, that things started to shift. It wasn't about getting rich quick; it was about building a life of freedom, security, and choices.

I've seen firsthand how financial stress can weigh on families, steal joy, and limit opportunities. And I truly believe that financial knowledge shouldn't be a privilege; it should be something everyone has access to. That's why I've put together this list – a collection of books that I believe can empower you to take control of your finances, build wealth, and create a richer, more fulfilling life. These aren’t complicated financial textbooks. They're stories, strategies, and perspectives that can help you understand your relationship with money and pave the way for a brighter future. Let's dive in.

Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required

This inspiring guide offers a no-nonsense approach to achieving financial independence and retiring early, without relying on luck or inherited wealth. The authors, who have both successfully retired at a young age, share their mathematically proven formula for growing wealth and building a secure financial future. They stress the importance of cutting down on unnecessary spending without sacrificing quality of life, and provide strategies for building a million-dollar portfolio and fortifying investments to weather bear markets and unexpected events. The authors also share their personal experiences, including Kristy Shen's remarkable story of retiring with a million dollars at just 31 years old. Their approach is accessible to everyone, not just entrepreneurs or real estate investors, and provides a clear roadmap for those seeking to break free from the traditional 9-to-5 grind and live life on their own terms. By applying the authors' principles and strategies, individuals can create a financial safety net, achieve financial independence, and enjoy the freedom to pursue their passions without the burden of a steady income.

Discover this book on Amazon (affiliate link)

Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle Class

This book is a powerful resource for anyone looking to build a strong financial foundation. The author, a former vice-chairman of the U.S. President's Advisory Council on Financial Literacy, shares his expertise to help everyday Americans take control of their financial future. With an insightful foreword by Doug McMillon, president and CEO of Walmart Inc., this book is an accessible guide that explains the importance of creating wealth for yourself and your family, regardless of your background or education. The author tackles tough money questions, such as the utility of new financial inventions like cryptocurrency, and provides clear discussions of the principles of responsible long-term investing. He also helps readers understand the value of exchanging time and effort for money and when it's best to agree to work. The book is a must-have for working professionals, blue-collar workers, young families, and established businesspeople who want to build a rock-solid financial foundation and create a better future for themselves and their loved ones. The author's goal is not to make the book easy, but to make it necessary, and to make readers understand that financial freedom is within reach, regardless of where they are in their lives.

Discover this book on Amazon (affiliate link)

The Automatic Millionaire, Expanded and Updated: A Powerful One-Step Plan to Live and Finish Rich

Here's a summary of the book in a blog post format:

Living a life where you have financial security and freedom to pursue your passions is a dream many of us have, but few achieve. I remember a friend of mine who was stuck in a cycle of living paycheck to paycheck, constantly stressed about money, and never able to save for the future. They felt like they were missing out on so much, and it was heartbreaking to see them go through it. But then they discovered a simple yet powerful system that changed their life forever. This system, outlined in a book that has sold over 1.5 million copies, takes advantage of the little things in life and turns them into a powerful force for financial freedom. The author, David Bach, presents a one-step program that requires no discipline or budget, just a willingness to automate your finances and take advantage of the power of compounding. By following this program, you can stop worrying about money, retire richer, and make a difference in the world. The book explains how to use the "latte factor" - the money you spend on small luxuries that add up over time - to save thousands of dollars per year. It also provides tips on how to invest wisely, make the most of tax-advantaged accounts, and use technology to automate your financial life. This new edition of the book includes even more updated information on how to make the process even easier and more accessible. With its clear and concise language, this book is a must-read for anyone looking to take control of their finances and start building wealth.

Discover this book on Amazon (affiliate link)

Deeper Than Money: Ditch Money Shame, Build Wealth, and Feel Confident AF

Deeper Than Money is more than just a book about finances, it's a journey to help you find financial confidence and live a life that truly matters. I still remember when I first struggled with money, I felt so guilty about spending even the smallest amounts, and I was always worried about the future. But as I continued to read and learn, I realized that I wasn't alone in this feeling and that it's time to change the way we talk about money. This book is written by someone who has been in my shoes, Chloe Elise, a money expert, podcaster, and CEO who shares her personal story of going from debt to financial freedom. With her guidance, you'll learn how to break free from the guilt and shame that holds us back and start building wealth that truly works for you. You'll discover how to live your life, love your finances, and make money matter less. You'll learn how to talk about money at brunch with your friends and finally get ahead with money without sacrificing what you care about. This book is a must-read for anyone who feels stuck in cycles of guilt around spending and wants to take control of their finances. With its practical advice and motivational kick in the butt, Deeper Than Money will help you level up not only your finances, but also your life, so you can enjoy the wealth you're building and the life you're living.

Discover this book on Amazon (affiliate link)

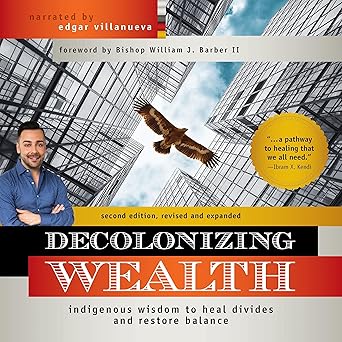

Decolonizing Wealth (Second Edition): Indigenous Wisdom to Heal Divides and Restore Balance

The world is out of balance and it's imperative to acknowledge the systemic racism and colonial structures that are foundational principles to our economies. The $1 trillion philanthropic industry, for instance, mirrors oppressive colonial behavior, with a name that means "the love for humankind" yet does more harm than good. Recent years have shown us that this imbalance is inescapable, with increasing frequency, and it's time to look beyond the glamorous, altruistic façade of philanthropy and into its shadows: white supremacy, savior complexes, and internalized oppression. For centuries, the accumulation of wealth has been steeped in trauma, and it's hard to imagine how we can shift philanthropy toward social reconciliation and healing when the cornerstones are exploitation, extraction, and control. Drawing from native traditions, Edgar Villanueva empowers individuals and institutions to begin to repair the damage through his seven steps to healing, which include decolonizing entertainment, museums, libraries, land ownership, and much more. What's particularly inspiring is that Villanueva has added inspiring examples of people using their resources to decolonize these sectors. The truth is that we all have the power to be healers and leaders in restoring balance, and we all need everyone's part. Villanueva reminds us that "all our suffering is mutual, all our healing is mutual, and all our thriving is mutual." It's a powerful message that requires our collective attention and effort. As we move forward, it's essential to recognize that we are all in this together and that our individual actions can collectively make a difference.

Discover this book on Amazon (affiliate link)