Sometimes, I think back to when I was younger, and all I wanted was to feel secure. Not just happy, but secure. I remember worrying about bills, feeling like I was one unexpected expense away from a real problem. It wasn't about wanting a fancy car or a huge house; it was about the simple peace of knowing I could handle whatever life threw my way.

That feeling, that peace of mind, is what I believe financial well-being can bring. It’s not about getting rich quick, it’s about building a foundation – a solid plan – that allows you to breathe easier and focus on what truly matters.

I’ve put together a list of books that I think can really help with that. These aren't complicated textbooks or filled with confusing jargon. They're filled with real stories, practical advice, and a whole lot of encouragement. Whether you're just starting out or have been on this journey for a while, I hope you find something here that resonates and helps you unlock your own financial future. Let’s build that foundation together.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

This book is about something that affects us all, but often we don't think about it until it's too late. It's about how we behave when it comes to money, and how that affects our lives. The author, Morgan Housel, shares 19 short stories that explore how people think about money and makes us realize that money isn't just about numbers and figures, but about our personal history, our values, and our emotions. We've all been there, making a financial decision that doesn't feel right, but we can't quite put our finger on why. This book helps us understand why we make the choices we do, and how we can make better decisions that align with our goals and values. I remember when I first read this book, I was surprised at how much it resonated with me. I realized that my own financial decisions were being influenced by my upbringing, my relationships, and my own fears and biases. It's a book that will make you think, make you feel, and maybe even change the way you think about money forever. It's a book that will help you understand why some people are wealthy, while others struggle to make ends meet. It's a book that will help you make better sense of one of life's most important topics, and help you create a more fulfilling life for yourself.

Discover this book on Amazon (affiliate link)

Mind Your Money: Insightful Stories and Strategies to Help You Reach Your #MoneyGoals

This book tells the story of how to manage your finances in a way that's relatable and easy to understand. The author shares personal anecdotes and experiences from her own life, making the book feel more like a conversation with a friend than a traditional self-help book. Through these stories, she breaks down complex financial concepts into manageable and actionable steps, making it simple for anyone to improve their financial situation. The author's approach is not just about providing advice, but also about changing the way you think about money and your relationship with it. She encourages readers to be honest with themselves about their spending habits and to make small, incremental changes that can add up to make a big difference over time. With a dash of humor and a whole lot of empathy, the author helps readers to see that managing their money is not just about numbers and budgets, but about achieving financial freedom and peace of mind. By sharing her own struggles and successes, the author shows that anyone can overcome financial challenges and reach their financial goals, no matter where they start.

Discover this book on Amazon (affiliate link)

Clever Girl Finance, Expanded & Updated: Ditch Debt, Save Money and Build Real Wealth

This book is a guide that helps women take control of their finances and achieve financial independence. The author, Bola Sokunbi, shares her expertise and knowledge to create a comprehensive plan for building a strong financial future. She starts by teaching readers the importance of setting personal money values, goals, and beliefs, and how to overcome limiting beliefs about money. This is a crucial step, as it helps readers identify what they truly want from their financial journey and makes it easier to stay on track.

The book also provides practical strategies for managing and eliminating debt, such as creating a debt repayment plan, negotiating lower interest rates, and prioritizing high-interest debt. This is a common challenge many women face, but with the right approach, it's achievable. The author also shares insights into different saving strategies, including emergency funds, retirement savings, and other long-term financial goals. She also explains how to invest with a small amount of money, which can be intimidating for some, but is essential for building long-term wealth.

Throughout the book, the author uses real-life examples and anecdotes to make the concepts more relatable and accessible. This approach makes the book feel more like a conversation with a trusted friend or advisor, rather than a dry textbook. The author's enthusiasm and encouragement are contagious, and her passion for helping women achieve financial independence is palpable. By the end of the book, readers will have a clear understanding of how to create a resilient budget, improve their credit score, pay down debt, and build long-term wealth. The result is a strong foundation for achieving financial independence and success.

Discover this book on Amazon (affiliate link)

Dave Ramsey's Complete Guide To Money

If you're looking for a straightforward guide on how to manage your finances, this book is an excellent resource. The author, Dave Ramsey, shares his expertise on personal finance in a way that's easy to understand and apply. The book covers a wide range of topics, from budgeting and saving to getting rid of debt and investing. You'll also learn about different types of insurance, mortgage options, marketing strategies, and bargain hunting tips. What I found particularly useful about this book is its focus on the importance of giving. Giving doesn't have to mean writing a large check to charity; it's about being mindful of how we spend our money and using it to make a positive impact on our lives and the lives of those around us. I remember when I was in my early twenties and was struggling to make ends meet. I was working multiple jobs and living paycheck to paycheck, with little to no savings. This book's principles and strategies helped me to get my finances in order and achieve financial peace. The book is written in a friendly and approachable tone, making it easy to read and understand, even if you're new to personal finance. The author's passion for helping people take control of their finances is evident throughout the book, and I found myself feeling motivated and inspired to make positive changes in my own financial life. Overall, this book is an excellent resource for anyone looking to improve their financial literacy and achieve financial peace.

Discover this book on Amazon (affiliate link)

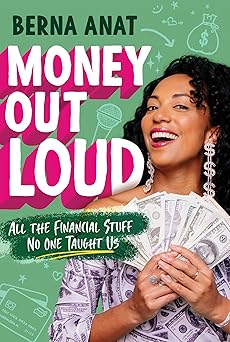

Money Out Loud: All the Financial Stuff No One Taught Us―Financial Literacy for the Confused and Anxious

Let's dive into the world of personal finance with a book that's about to change the way we think about money. In this illustrated guide, the Financial Hype Woman, Berna Anat, takes it upon herself to have an unapologetically open and honest conversation with her immigrant parents about something that's long overdue: talking about money. You see, no one ever taught her about money, and she's not alone. We've all been there - feeling anxious, ashamed, and silent about our financial lives. But it's time to break free from those toxic patterns and learn how to make money work for us, not against us. With Berna's help, we can finally understand the basics of budgeting, saving, and investing in a way that's actually fun. We'll explore how our past traumas shape our financial habits and learn how to create new, healthier ones. We'll also discover how to build wealth in a system that's stacked against us and use money to fund our biggest dreams and make a real difference in the world. The goal is to grab the mic and take control of our financial lives, no longer letting money be a source of stress and anxiety. By the end of this journey, we'll be armed with the knowledge and confidence to make informed decisions about our money and start living the life we truly want.

Discover this book on Amazon (affiliate link)