I look back at my younger self and just want to give her a hug. She was so worried about making ends meet, about whether there would be enough. It felt like a constant weight, a shadow hanging over everything. I remember feeling helpless, like there was nothing I could do to change things. Then, I started learning – small steps at first, reading articles, talking to people who seemed to have a better handle on things. And slowly, things started to shift. It wasn't about getting rich; it was about feeling secure, about having choices.

That’s why I’m so excited to share this curated list with you. Building a solid financial foundation isn’t about complicated jargon or needing a fancy degree. It's about understanding some basic principles and taking small, consistent actions. These books aren’t just about money; they're about peace of mind, about building a future where you feel empowered and in control. Let’s explore these resources together, and start building that brighter future, one page at a time.

Financial Freedom: A Proven Path to All the Money You Will Ever Need

This book offers a refreshing take on traditional financial wisdom, challenging many of the long-held beliefs about money, work, and retirement. The author shares his personal story of turning his financial life around, from having only $2.26 in his bank account at 24 to achieving financial independence by 30. He reveals that most conventional advice on saving and investing is either outdated or incomplete. Instead, he provides actionable steps to create profitable side hustles, save money without sacrificing happiness, and live more freely.

The author's advice is centered around the idea that financial freedom is achievable, but time is limited. He emphasizes that while it's possible to make a lot of money, there's a limit to how much you can save, but not to how much you can earn. This book is not a get-rich-quick scheme, but a practical guide to living life on your own terms as soon as possible. It's a must-read for anyone looking to break free from the traditional 9-to-5 mentality and create a life of financial independence, freedom, and happiness.

Discover this book on Amazon (affiliate link)

Priceless Facts about Money (Mellody on Money)

As I sat down to read this book, I couldn't help but think about how many times I had struggled to understand the basics of money when I was a child. It's amazing how much more straightforward it all seems now, but I also remember the frustration and confusion that came with it. That's why I loved seeing Mellody Hobson's attempt to demystify money for kids - it's both fun and approachable. The book is full of fascinating facts, from the origins of the word "greenbacks" to how meteorites created the first mineral deposits that led to the creation of money. Mellody Hobson explains it all with such enthusiasm and wit, making even the most daunting topics seem exciting and accessible. I also appreciated the insertion of illustrations and amusing skits that showcased a seemingly ordinary bunny and cat having a conversation about money - it added a layer of playfulness to the text. As I flipped through the pages, I couldn't help but feel a sense of accomplishment whenever I learned something new. Mellody Hobson has done an incredible job bringing financial literacy to life in a way that's both entertaining and educational.

Discover this book on Amazon (affiliate link)

Rich Man Poor Bank: What the Banks Don't Want You to Know About Money

This book is a must-read for anyone looking to take control of their finances and break free from the grip of the banking system. The author shares a personal story of being trapped in a cycle of debt and financial struggles, only to discover the truth about how banks manipulate people into debt. The author's message is clear: you don't need a bank to save, borrow, or invest, and that by learning how to manage your own finances, you can put your money to work for you, rather than the other way around. The author's goal is to educate people on how to cut ties with mega-banks and escape the debt matrix, allowing individuals to invest in tax-free accounts and even invest without risk, just like the rich. The book is full of practical tips and strategies for achieving financial freedom, from understanding how banks make money to learning how to create a budget that works for you, not against you. With a dash of personal vulnerability and a healthy dose of skepticism towards the banking industry, this book is a wake-up call for anyone looking to take charge of their financial future.

Discover this book on Amazon (affiliate link)

Top 25 Ways an IUL can Secure Your Financial Future: And Build a Tax-Free Family Bank!

This book is about a financial strategy called Indexed Universal Life Insurance that can help you secure your financial future. Imagine having a safety net that protects you from taxes and market downturns, and allows you to grow your wealth even during economic uncertainty. The author explains how many American families are using this strategy to hedge against inflation, rising taxes, and economic downturns. They also share how you can use Indexed Universal Life Insurance to build a personal tax-free family bank, which can be used to borrow money for investments, expand your business, or generate returns far greater than what most investors earn. The book also talks about how this strategy can help you grow your retirement accounts and ensure you have enough money during your retirement years. What's more, the author reveals a secret used by the wealthy to grow their wealth, which is called "Other People's Money" (OPM).

Discover this book on Amazon (affiliate link)

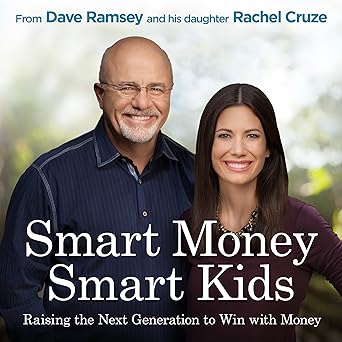

Smart Money Smart Kids: Raising the Next Generation to Win with Money

Raising the next generation to win with money is a daunting task in today's debt-filled world. As a parent, it's natural to want the best for your children, and that includes teaching them how to manage their finances effectively. This book, written by Dave Ramsey and his daughter Rachel Cruze, is a comprehensive guide that provides a no-nonsense, common-sense approach to raising money-smart kids. The authors start by teaching children the basics of working, spending, saving, and giving, which are essential skills to develop in order to set them up for financial stability. However, they also tackle more complex issues like avoiding debt for life, paying cash for college, and battling discontentment. What struck me about this book is its emphasis on the importance of teaching children the value of hard work and the dangers of debt. The authors share personal anecdotes and practical advice, making it easy for parents to put the book's principles into practice. By following the book's guidance, parents can equip their children with the skills they need to succeed financially and set them up for a lifetime of financial freedom.

Discover this book on Amazon (affiliate link)