Sometimes, I think back to when I was just starting out. I remember feeling so lost when it came to money. It felt like everyone else had a secret language I couldn’t understand, and I was just trying to keep my head above water. I’m not talking about being rich here; I just wanted to feel secure, to know I could handle whatever life threw my way. It felt overwhelming.

I know a lot of you might feel the same way. Maybe you’re staring at your bank account feeling anxious, or maybe you dream of owning a home but don’t know where to start. It's okay to feel that way. Money can be a scary topic. But I also know that with a little bit of knowledge and some simple steps, you can take control of your finances and build a brighter future.

That's why I put together this list of books. They’re not about complicated investments or getting-rich-quick schemes. They are about understanding the basics, building good habits, and feeling confident about your financial journey. They're for everyone, no matter where you are starting from. Let's learn together and build that financial freedom we all deserve.

She's on the Money

This book is a game-changer for anyone struggling to manage their finances. The author, Victoria Devine, has created a comprehensive guide that not only shares her expertise but also offers a supportive community of women who have successfully found their way to financial freedom. With her phenomenally popular podcast, She's on the Money, Victoria has built a loyal following of women who are eager to learn how to take control of their money. What's impressive is that Victoria's approach is honest, relatable, and non-judgmental, making it easy for readers to feel comfortable and empowered as they work through the material. The book is filled with real-life stories from members of the She's on the Money community, who candidly share their experiences, wins, and lessons learned. These stories are not only inspiring but also provide valuable insights into the sometimes-tricky psychology surrounding money. Through the book, Victoria offers clear steps on how to budget, clear debts, build savings, start investing, and even buy property. She also provides practical advice on how to establish values, habits, and confidence when it comes to managing your finances. With templates and activities throughout, readers can immediately put Victoria's recommendations into action in their own lives. One of the most reassuring things about this book is that you're not alone on your financial journey. Victoria's guidance and the support of the She's on the Money community make you feel like you can go further than you ever thought possible.

Discover this book on Amazon (affiliate link)

Clever Girl Finance, Expanded & Updated: Ditch Debt, Save Money and Build Real Wealth

This book offers a comprehensive guide to achieving financial independence and security. The author, Bola Sokunbi, shares her expertise to help women take control of their finances and build a strong and prosperous future. The book is filled with practical advice and actionable steps that can be applied to real-life situations. Sokunbi emphasizes the importance of mindset shifts and developing good financial habits, such as overcoming limiting beliefs about money and cultivating healthy financial habits. She also provides strategies for managing and eliminating debt, exploring different saving strategies, and learning about investment options. The author shares personal stories and real-life examples to illustrate her points, making the book relatable and accessible. Throughout the book, Sokunbi encourages readers to identify their personal values, goals, and beliefs, and to explore ways to align their financial actions with their goals. With its down-to-earth approach and focus on empowerment, this book is a valuable resource for women looking to improve their financial situation and achieve success. The author's goal is to provide a supportive and non-intimidating guide to help readers make progress towards their financial goals, and to help them build a brighter financial future.

Discover this book on Amazon (affiliate link)

If You Can: How Millennials Can Get Rich Slowly

This booklet is a refreshing guide that sheds light on a crucial aspect of financial health: retirement savings. Written with empathy and understanding, it tackles the daunting task of investing for the future, making it accessible to young people who may feel overwhelmed or uncertain about managing their finances. The author's personal experience and passion for helping millennials achieve financial security shine through, as they share practical advice and strategies for building wealth over time. The book's straightforward approach and use of relatable analogies, such as exercising and eating less to lose weight, make it easy to comprehend and apply. However, the author also acknowledges that financial literacy is not always a natural talent, and that's where this booklet comes in - to equip readers with a solid foundation in finance, helping them navigate the often-complex world of investing and avoid common pitfalls. By following the author's guidance, young people can take control of their financial future and build a secure retirement. The booklet's free availability makes it an ideal resource for those looking to start their financial journey, and the paperback version is a thoughtful gift for friends and family who are also seeking guidance.

Discover this book on Amazon (affiliate link)

Finance for the People: Getting a Grip on Your Finances

This book is a game-changer when it comes to understanding and managing your finances. The author, Paco de Leon, who has years of experience in the financial industry, shares a unique approach that goes beyond just providing tips and tricks. Instead, she invites readers to examine their deep-rooted beliefs and experiences around money, making it a journey of self-discovery and growth. The book is filled with practical exercises, mindfulness practices, and over 50 illustrations and diagrams that make the concepts accessible and even fun to learn. With her expertise, Paco helps readers to root out their unconscious beliefs about money, untangle the emotional burden of student loans, and build wealth. What I love most about this book is its kind and compassionate tone, which makes readers feel seen and heard. The author's goal is not to lecture or scare people into saving money, but to empower them with the knowledge and tools to take control of their financial lives. I've seen this firsthand in my own life and the lives of others who have struggled with financial insecurity, and I can confidently say that this book is a must-read for anyone who feels lost or stuck in their financial journey. By the end of this book, you'll walk away with a newfound understanding of your relationship with money and a sense of financial freedom that's hard to put into words.

Discover this book on Amazon (affiliate link)

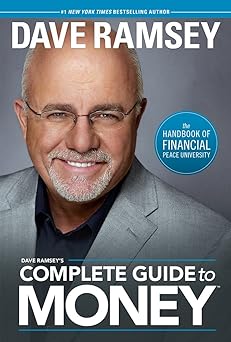

Dave Ramsey's Complete Guide To Money

This book is a comprehensive guide to managing your finances, written by a well-known personal finance expert. The author provides practical advice on how to take control of your money, covering topics such as budgeting, saving, getting rid of debt, and investing. The book also includes information on insurance, mortgage options, marketing, bargain hunting, and the importance of giving. It's a must-have resource for anyone looking to learn how to manage their finances, and is particularly useful for those who have already learned about personal finance but are looking for a comprehensive guide to have on their bookshelf. The book is a culmination of the author's money teachings, and covers the "Baby Steps" that he wrote about in another book. If you're new to personal finance or are looking for a one-stop resource, this book is an excellent choice. It's a thorough and practical guide that will help you make informed decisions about your money and achieve financial peace. The author's approach is straightforward and easy to understand, making it accessible to readers of all backgrounds.

Discover this book on Amazon (affiliate link)