Sometimes I think back to my grandmother. She worked so hard her entire life, a seamstress with nimble fingers and a quiet determination. When she finally reached retirement, she worried. Not about having fun, but about having enough. Enough to cover the unexpected, enough to not be a burden on my family. That worry, that quiet fear, stayed with her.

I’m sharing this because I believe everyone deserves to feel secure in their later years. Planning for retirement can feel overwhelming, filled with confusing terms and complicated strategies. But it doesn't have to be! It's about understanding the basics, making smart choices, and feeling confident about your future.

That’s why I’ve put together this list – a collection of books designed to guide you, step-by-step, towards financial peace of mind. Whether you're dreaming of a cozy cabin in Alaska, planning for healthcare needs, or simply wanting to feel more in control of your financial destiny, these books offer practical advice and clear explanations. Let’s begin this journey together, and build a future where worry gives way to joy and security.

Pathway to Prosperity: Your Guide to Money and Economics

This book is about taking control of your finances and making informed decisions about money. I remember when I was struggling to pay my bills on time, feeling overwhelmed and anxious about my financial situation. But then I started learning about personal finance and investing, and it completely changed my life. The author of this book is very clear and concise in explaining complex financial concepts, making it easy to understand even for those who are new to the topic. The book covers a wide range of topics, from budgeting and credit management to investing and risk management, and it's all explained in a practical and easy-to-follow manner. The author also emphasizes the importance of learning and taking control of your finances, which I think is a really empowering message. Throughout the book, I was able to find myself in the author's examples and anecdotes, which made the information feel even more relatable and accessible. By the end of the book, I felt much more confident and in control of my finances, and I was able to start making better decisions about money. The author's goal is to help readers develop a clear understanding of personal finance that will give them the confidence to make better decisions in their day-to-day lives. Overall, I found this book to be a comprehensive and easy-to-understand guide to money and economics, and it's definitely a valuable resource for anyone looking to improve their financial literacy.

Discover this book on Amazon (affiliate link)

Outsmarting the System: Lower Your Taxes, Control Your Future, and Reach Financial Freedom

This book offers a simplified approach to understanding taxes, making it accessible to those with limited time to read. The author's goal is to provide a high-level overview of tax strategies, allowing readers to gain control over their financial future. The book explains how the rich lower their taxes, sharing the pros and cons of three primary strategies and offering practical advice on how to implement them. The author assumes a busy individual with limited time to read, using concise language to convey complex tax concepts. The book provides a unique insight into tax laws and offers a refreshing alternative to the common, often overwhelming, advice on taxes. By following the strategies outlined in this book, readers can take the first steps towards joining those who have successfully "outsmarted the system" and achieved financial freedom.

Discover this book on Amazon (affiliate link)

Understanding Investing with Plain Talk and Common Sense

This book is a must-read for anyone looking to take control of their financial future. I can personally relate to the struggle of trying to navigate the overwhelming world of investing, feeling like a bystander to our own money. The author's approach is refreshingly straightforward, and I found myself appreciating the concise and accessible language used throughout the book. The book provides a wealth of practical tools and checklists, such as the "Financial Self Portrait" and "Buy Right and Sell Right", which I found incredibly helpful in solidifying my own understanding of investing basics. What struck me most about this book, however, was its focus on emotional awareness – understanding how we react to money and investing, and how that influences our decision-making. The author's emphasis on recognizing and managing our emotions when it comes to investing is a crucial aspect of achieving long-term success. By taking a step back and understanding our own emotional responses to financial situations, we can avoid making rash decisions and instead make informed choices that align with our values and goals. This book has truly been a game-changer for me, and I believe it can have the same impact on anyone who reads it.

Discover this book on Amazon (affiliate link)

The Art of Investing: How to Make Money While You Sleep | Learn How to Pick Stocks Easily and Unlock Your Financial Freedom through Investing in the Stock Market

Investing in the stock market can seem like a daunting task, especially for those who are new to the world of finance. However, with the right mindset and guidance, anyone can learn to invest with confidence. The book takes a unique approach by delving into the psychology of wealth creation, helping readers to identify their own strengths and weaknesses when it comes to investing. By mastering the art of risk management and decision-making, readers can gain a deeper understanding of the stock market and make more informed investment decisions. One of the most appealing aspects of this book is the idea of making money while you sleep, and the author provides practical tips and strategies for achieving this goal. For instance, the book explains how to identify investing opportunities, how to pick winning stocks, and how to properly diversify a portfolio. The author also provides checklists and tools to help readers stay on track and make the most of their investments. What sets this book apart from others is its focus on empowering readers to take control of their financial future. Through real-life examples and case studies, the author shows how anyone can build a successful investment strategy that aligns with their values and goals. By the end of the book, readers will be equipped with the knowledge and confidence to start building their financial future, and the author provides a wealth of resources, including tools and websites, to support their journey. Whether you're just starting out or looking to brush up on your investing skills, this book offers a comprehensive and accessible guide to unlocking your financial potential.

Discover this book on Amazon (affiliate link)

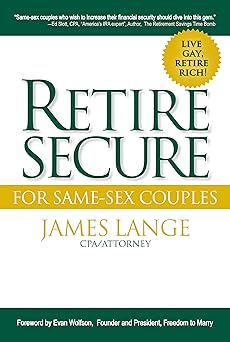

Retire Secure!: For Same-Sex Couples

This book is an incredibly insightful guide for same-sex couples who want to retire secure and live comfortably. The author shares a powerful story of two gay couples with identical financial resources, one of whom failed to plan for retirement and the other who followed the advice in the book. The author's simple yet effective strategies have a profound impact on the second couple's financial future, leaving them with a substantial nest egg and a portfolio that continues to grow. What's remarkable is how the author's advice can make a significant difference in one's retirement prospects, from getting married and taking full advantage of social security to using key IRA and retirement plan estate planning strategies. The author's approach is relatable and easy to understand, making it accessible to anyone who wants to plan for a secure retirement.

Discover this book on Amazon (affiliate link)