Sometimes, I think about my grandma. She worked so hard her whole life, always putting everyone else first. When she finally reached retirement, she worried constantly – not about having fun, but about having enough. Seeing her stress like that really stuck with me. It made me realize how important it is to feel secure about your future, to know you’re going to be okay, especially when you’re ready to relax and enjoy the fruits of your labor.

Planning for retirement can feel overwhelming, full of confusing numbers and complicated strategies. It’s easy to put it off, to think “I’ll deal with that later.” But later can arrive faster than you think, and feeling prepared can make all the difference in your peace of mind. That’s why I’ve put together this list – a collection of books that break down retirement planning in a way that’s easy to understand and, honestly, even a little bit comforting. These aren’t textbooks; they’re guides to help you feel in control of your financial future and step confidently into your retirement years.

Effortless Savings: A Money Management Guide to Saving Without Sacrifice

This book is a comprehensive guide to saving money without sacrificing one's lifestyle. The author understands that many people struggle to cut back on their spending habits, and the book provides a simple and practical solution. The strategies outlined in the book cover a wide range of areas, from grocery shopping and banking to credit card techniques and reducing energy bills. The author emphasizes that saving money doesn't have to mean giving up on the things we enjoy, but rather finding creative ways to make adjustments. I remember when I was trying to save money on a tight budget, I found it challenging to cut back on dining out and entertainment. But this book showed me that there are easy and painless ways to reduce these expenses, and the tips in the book have been instrumental in helping me achieve my financial goals. The author's approach is empowering, and the book is perfect for readers of all income levels and household sizes. What I find particularly impressive is that the strategies in the book are not just limited to low-income households, but can be applied by anyone looking to save money without sacrificing their lifestyle. I've seen firsthand how effective this book can be in teaching people how to manage their finances and make substantial savings. The University of New Brunswick has already adopted this book for their Personal Financial Planning Course, and I can see why - it's a valuable resource that can help anyone achieve financial stability.

Discover this book on Amazon (affiliate link)

Retirement Reboot: Commonsense Financial Strategies for Getting Back on Track

For millions of Americans, the COVID shock has brought retirement saving to an abrupt halt—now it's time to get back on track. Even before the pandemic, a large share of households by Americans over age fifty faced the threat that their living standards would decline sharply in retirement. It's devastating to think that a significant portion of retirees will have to live on reduced budgets, due to circumstances that are often beyond their control. In a world where financial uncertainty is rife, I wanted to help my own family members think more clearly about their retirement planning. I've always believed that every generation deserves to live with dignity and financial security in their twilight years. That's why I was inspired to write about practical strategies for getting back on track. The book offers a clear roadmap for Americans to improve their retirement prospects, even if retirement is just a few years away. You'll learn how to make a plan, think through the timing of retirement, optimize Social Security, navigate Medicare, build savings, and tap home equity. You'll also explore ongoing strategies to make the most of your remaining working years, such as careful budgeting, generating income from work even after retirement, planning for long-term care, and accessing special assistance for low-income workers.

Discover this book on Amazon (affiliate link)

The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work, and Living

This book is a practical and straightforward guide to overcoming the retirement challenges we all face. The author tackles the tough questions about retirement in the new post-crash economy with a clear and accessible style. It puts retirement in perspective by discussing important issues such as insuring against the risk of outliving your assets, recalibrating damaged retirement portfolios, managing the risk of health-care expenses in retirement, and career strategies for workers who are 50 years old and up. The book reveals how to boost lifetime income through better planning and working just a few additional years, and it offers advice on how to hire a financial advisor whose first loyalty is to you, not Wall Street. It also discusses why you should rethink housing in the wake of the real estate crash, and it provides detailed advice on career reinvention, the 50+ job market, and midlife entrepreneurship. This book is engaging and informative, and it provides the strategies needed for a truly fulfilling and secure retirement. The author's approach is empathetic and understanding, making it easier for readers to tackle their own retirement challenges.

Discover this book on Amazon (affiliate link)

Executor Help: How to Settle an Estate Pick an Executor and Avoid Family Fights

I recently listened to an audiobook that really made me think about the importance of planning for the future. The author, David Edey, shares his personal experience of having to deal with the aftermath of not having a plan in place when it comes to estate settlement. He emphasizes how crucial it is to appoint an executor who can handle the tasks of distributing assets, paying debts, and taking care of any remaining family members. Edey explains that this designated person can make a huge difference in ensuring that the deceased's wishes are respected and that the family's wealth is used to benefit everyone involved. He also highlights the potential pitfalls that can arise when family members don't communicate effectively or when they're too caught up in their own interests. The audiobook is filled with practical advice and real-life examples that illustrate the importance of having open and honest conversations about death and inheritances before it's too late. By planning ahead and choosing a responsible executor, individuals can save themselves a lot of stress, money, and potential conflicts.

Discover this book on Amazon (affiliate link)

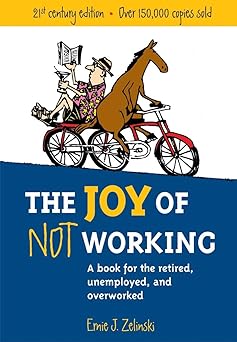

The Joy of Not Working: A Book for the Retired, Unemployed and Overworked- 21st Century Edition

For decades, many people have found themselves stuck in the monotony of their daily routine, feeling like something is missing from their lives. However, what if I told you that there's a way to break free from this cycle and find true fulfillment? The author has worked with over 300,000 people, helping them to realize that work and play, employment, and retirement are not mutually exclusive. In fact, they can be intertwined in a way that brings joy and satisfaction to every aspect of your life. By adopting a more mindful approach to your daily activities, you can become more productive, pursue your passions, gain the courage to leave a job that's draining your life, and find financial independence with less money. The book offers practical advice, illustrated with eye-opening exercises, thought-provoking diagrams, and lively cartoons and quotations, to help you achieve a better work-life balance. But what's even more inspiring is the impact that this book has had on the lives of its readers. Thirty inspiring letters from readers share how the book helped them improve the variety, tone, and quality of their lives. This book is a wake-up call to rethink the way we approach life, and I can attest to its power to transform lives. If you're feeling stuck, I encourage you to take a closer look at this book and see if it can help you unlock a more joyful and satisfying life.

Discover this book on Amazon (affiliate link)