The biggest dreams aren't about climbing a career ladder or achieving a certain title. They’re about what comes after – that beautiful, earned chapter we call retirement. I remember my own grandmother, bless her heart, worrying constantly about whether she's done enough, saved enough, to truly enjoy those years. She’s not alone. Many of us carry that same quiet anxiety, that fear of the unknown.

It's okay to feel that way. Planning for retirement – whether it’s thinking about where you’ll live, how you’ll spend your days, or, importantly, how you’ll manage your finances – can feel overwhelming. It's a big shift, and it's natural to want to feel prepared. That’s why I’m so excited to share this curated list of books with you. These aren’t dry, complicated textbooks. They're friendly guides, filled with practical advice and encouraging stories, designed to help you feel confident and excited about your future. Let’s build a retirement filled with peace of mind, joy, and the freedom to truly live.

The Only Investment Guide You'll Ever Need: Revised Edition

This book is more than just a guide to managing your money, it's a comprehensive resource that offers practical advice and reassurance for anyone looking to make the most of their finances. The author's approach is down-to-earth and easy to understand, making it accessible to readers who may feel overwhelmed by the world of investing. What resonated with me was the way the book addresses real-life scenarios, such as the impact of climate change on investing and the rise of cryptocurrency. I found it remarkable how the author weaves together seemingly disparate elements, like the experience of investing through Robinhood during the GameStop frenzy, to create a cohesive and reassuring narrative. What struck me most was the author's ability to explain complex concepts in simple terms, dispelling fears and misconceptions that often come with personal finance. The author's wit and empathy shine through on every page, making the book a pleasure to read and a trusted companion for anyone looking to navigate the world of investing and build a more secure financial future.

Discover this book on Amazon (affiliate link)

Retire Secure!: A Guide To Getting The Most Out Of What You've Got, Third Edition

This comprehensive guide is designed to help readers make the most of their retirement assets, providing clear and actionable advice on how to maximize their benefits from IRAs and other retirement plans. The author's goal is to alleviate the widespread fear of running out of money in retirement, offering practical strategies for saving tens of thousands to over a million dollars. By paying taxes later, readers can significantly increase their retirement savings, and the book also provides valuable insights into converting to Roth IRAs, Roth 401(k), and Roth 403(b) rules. The author shares his own exceptional estate plan, which has been featured in notable financial journals, and the book has received glowing endorsements from renowned financial experts and authors. This guide is particularly relevant for baby boomers nearing retirement, as it offers a straightforward and accessible approach to retirement planning, making it an invaluable resource for both consumers and financial experts alike.

Discover this book on Amazon (affiliate link)

The Ultimate Book of Fun Things to Do in Retirement: Volume 1

Unleash your inner adventurer and get ready to plan an exciting, active, happy, healthy, and mentally sharp life after work. This jam-packed audiobook is designed to inspire you to live your best retirement life, offering hundreds of ideas to spark your imagination. You'll discover the seven first steps to rockin' the retired life, a simple secret to finding purpose and meaning in retirement, and practical advice on how to focus on what truly makes you happy and fulfilled. The audiobook is divided into several sections, each covering a different area of interest, including travel and adventure, outdoor activities, health and wellness, social opportunities, engaging hobbies, and useful technology. You'll find fantastic ideas for staying physically and mentally fit, ways to make new friends and stay socially active, and exciting new hobbies to unleash your creativity. The audiobook also delves into standout topics such as cruising, motorhome travel, photography, and more, providing a wealth of inspiration and guidance. Whether you're looking for tips on travel, hobbies, or social activities, this audiobook has something for everyone, with practical advice and inspiring ideas for every interest and mobility level. With its positive and enthusiastic approach, this audiobook is designed to help you approach retirement with a positive mindset and make the most of your golden years.

Discover this book on Amazon (affiliate link)

Retirement Reboot: Commonsense Financial Strategies for Getting Back on Track

As someone who has worked with many individuals approaching retirement, I can relate to the anxiety and uncertainty that comes with it. The COVID-19 pandemic has had a devastating impact on retirement savings for millions of Americans, leaving many feeling stuck and unsure of how to get back on track. The good news is that there is hope, and it starts with making a few simple decisions now. Finance writer Mark Miller's book, Retirement Reboot, offers a practical and compassionate guide to help Americans improve their retirement prospects. Miller takes the reader through the core decisions that can be made now to improve retirement outcomes, even if retirement is just a few years away. He walks the reader through the process of making a plan, thinking through the timing of retirement, optimizing Social Security, navigating Medicare, and building savings. He also explores ongoing strategies that can help generate income, plan for long-term care, and tap into home equity. One of the most reassuring aspects of this book is its focus on simple steps that can be taken to make the most of remaining working years. For those who have low savings or none at all, Miller's approach can be a lifeline. By taking control of their finances and planning for the future, individuals can reboot the retirement they always imagined and make the most of their golden years.

Discover this book on Amazon (affiliate link)

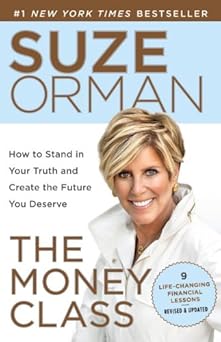

The Money Class: Learn to Create Your New American Dream

The journey to financial freedom is a transformative one, and this book is a beacon of hope for those seeking to create a better life for themselves and their loved ones. The author, a renowned financial expert, imparts valuable lessons in a way that is both practical and inspiring. You'll learn how to tap into your inner strength and confidence, and discover the power of standing in your truth. This newfound courage will empower you to make daily choices that will restore hope and positivity to your life. As you navigate the complexities of money and family, you'll be equipped with the tools and strategies necessary to avoid costly mistakes and achieve financial stability. Whether you're a career seeker, a homeowner, or a retiree, this book offers a comprehensive guide to help you plan for the future with confidence. You'll also learn how to rebuild your career or career prospects, and how to create a solid retirement plan that works for you, no matter where you are in life. This book is more than just a financial guide; it's a roadmap to a life of financial security, hope, and fulfillment. With its direct and accessible approach, you'll be able to apply the principles and strategies outlined in this book to transform your financial situation and create a brighter future.

Discover this book on Amazon (affiliate link)