Planning for the future can feel overwhelming, I get it. It’s easy to put it off, to think there’s always more time. But taking even small steps now can make a huge difference later. This isn't about getting rich quick; it’s about building a secure foundation for the life you want to live – a life filled with freedom, flexibility, and peace of mind. Let’s explore these books together and start building that future, one chapter at a time.

The Ultimate Retirement Guide for 50+: Winning Strategies to Make Your Money Last a Lifetime (Revised & Updated for 2025)

Retirement can be a life-altering experience, but it's also a daunting one, especially when it comes to managing finances. I remember talking to a friend who had just retired and was feeling overwhelmed by the thought of dealing with their own money. They had been working for decades, and suddenly, they were expected to make all the right decisions about their savings and investments. It's a lot to take in, especially when retirement rules keep changing. That's why I love this latest guide, which offers practical advice and tools for planning a secure retirement in today's ever-changing landscape. The author, a well-known personal finance expert, understands that retirement is not just about money; it's also about living your best life. They share stories, examples, and strategies for downsizing, spending wisely, delaying Social Security benefits, and more. What I appreciate most about this guide is the author's empathy and understanding of what it's like to be in this situation. They know that money decisions can be painful and that it's never just about money. They offer guidance on how to let go of regret and fear, and how to make the right choices for your own life and loved ones. The revised edition includes new rules and updates, reflecting recent changes in retirement rules passed by Congress. This guide is a must-read for anyone approaching retirement, as it provides the tools and support needed to make informed decisions and achieve their goals.

Discover this book on Amazon (affiliate link)

The Five Years Before You Retire: Retirement Planning When You Need It the Most

I recently read a book that truly resonated with me, and I think it could do the same for many readers who are approaching their retirement years. The book explores the critical five-year period leading up to retirement, where many people realize they may not have saved enough to maintain their desired lifestyle. The author takes a compassionate approach, understanding that this realization can be daunting and overwhelming. I recall a conversation I had with my own grandmother, who was in her early 60s and suddenly faced the harsh reality that she wouldn't have enough money for her retirement. Her anxiety and confusion were palpable, but with the guidance of this book, she was able to regain control and create a realistic plan for her future. The book provides straightforward advice and strategies for tackling financial, medical, and familial decisions, from maximizing employer match contributions to discussing housing options with family members. By breaking down the complexities of retirement planning into manageable parts, the author empowers readers to make informed decisions and create a comfortable life in their golden years. The book acknowledges that every individual's circumstances are unique, and it offers tailored guidance to help readers navigate the challenges of this critical period. Throughout the book, the author's empathetic tone and no-nonsense approach make the subject matter accessible and relatable, ensuring that readers feel supported and motivated to take action.

Discover this book on Amazon (affiliate link)

We're Talking Millions!: 12 Simple Ways to Supercharge Your Retirement

Understanding how to invest wisely for your future can be daunting, especially when it comes to making smart choices that can turn modest regular savings into a secure retirement. Many people never get started due to fear of making mistakes, while others make choices based on hearsay and hope, sold on hype or risk aversion. It's easy to feel overwhelmed by the vast amount of information available, and it's common to wonder if there's a foolproof way to ensure a comfortable retirement. However, what if I told you that with a few simple changes, you can significantly increase your chances of achieving financial security in your golden years? "We're Talking Millions!" offers a straightforward action plan that can be implemented in under an hour a year, making it an incredibly valuable investment of your time. By combining decades of academic-based knowledge and experience, financial expert Paul Merriman and co-author Richard Buck have created a comprehensive guide that demystifies the world of investing and provides actionable steps to get you started and stay on track. The book focuses on 12 simple yet powerful strategies that can add $1 million or more to your retirement nest egg, if implemented in your 20s or 30s. By taking control of your financial future and making informed decisions, you can break free from the cycle of uncertainty and secure a brighter, more prosperous tomorrow.

Discover this book on Amazon (affiliate link)

Passive Income, Aggressive Retirement: The Secret to Freedom, Flexibility, and Financial Independence (& how to get started!)

This audiobook is a guide that teaches you how to become financially free earlier than you ever thought possible. The author, a finance guru, shares her story of quitting her job at age 27 and retiring at 27, living off $10,000+ per month in passive income streams. She aims to show you how to achieve financial independence, retire early, and live life on your terms. With 28 tried and true passive income stream models, you can create consistent, long-term residual income, eliminate money stresses, and fears, and say goodbye to your 9-5 job. The author also interviews well-known experts, such as Hal Elrod, Bobby Hoyt, and David Osborn, who have successfully implemented these strategies in their own lives. You'll learn how to create passive income streams with little to no ongoing work, making it a realistic and achievable goal for anyone. Whether you're a college student, a couple, or a single parent, this audiobook is for you. By the end of it, you'll know exactly what it takes and how to get started on your journey to financial freedom.

Discover this book on Amazon (affiliate link)

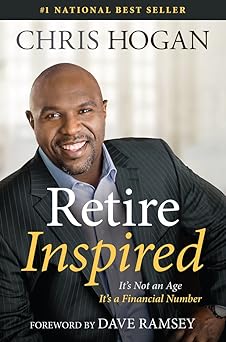

Retire Inspired: It's Not an Age, It's a Financial Number

This book is a wake-up call for anyone who's thought about retirement, but hasn't quite gotten their plans in order. The author, Chris Hogan, knows that retirement isn't just about when you stop working, it's about how you live the rest of your life. He believes that you can have a fulfilling retirement at any age, and that it's not just about the number of years you have left, but about the financial freedom you have. The book is full of real-life examples and practical advice on how to make smart decisions about money, investments, and life. You'll learn how to evaluate your current financial situation, make wise investing decisions, and build a team of experts to help you achieve your retirement goals. The author's enthusiasm and passion for helping people achieve financial freedom shine through on every page, making this book a must-read for anyone who wants to live a happy and fulfilling retirement.

Discover this book on Amazon (affiliate link)