Sometimes, I think back to my grandma, bless her heart. She worked so hard her whole life, a true Arkansas spirit, always putting others first. When she finally reached retirement, she worried. Not about having fun, but about whether her family would be okay. Would she be a burden? Could she afford the care she might need someday? That worry, that quiet fear, is something I’ve seen in so many families here in Fort Smith and across the state.

Planning for retirement isn't just about numbers and investments. It's about peace of mind – knowing your family is secure, understanding your health options, and feeling prepared for whatever the future holds. It’s about having the freedom to enjoy those precious years without a heavy weight on your shoulders.

That’s why I’ve put together this list of books. They're not complicated or filled with confusing jargon. They’re real-world guides, written in a way that everyone can understand, covering everything from financial planning and understanding the FIRE movement to thinking about important, but often uncomfortable, topics like estate planning and long-term care. My hope is that these books will help you and your loved ones navigate retirement with confidence and, most importantly, with joy.

The 9 Steps to Financial Freedom: Practical and Spiritual Steps So You Can Stop Worrying

Suze Orman's book offers a holistic approach to personal finance, focusing on the emotional and spiritual aspects of managing money. The author's personal journey and struggles with financial anxieties serve as a relatable backdrop for her guidance. She encourages readers to confront their fears and rewire their thinking to overcome financial barriers. By acknowledging the psychological impact of money on our lives, Orman provides a nuanced understanding of the complex relationships between our finances and our well-being. Her approach is centered on empowering individuals to take control of their financial lives, rather than simply providing technical advice. By exploring themes such as self-trust, receptivity, and the "money cycle," Orman offers a unique perspective on the importance of financial freedom, positioning it as a means to realizing one's true worth and potential. This book is a must-read for anyone seeking a more comprehensive understanding of personal finance, one that recognizes the intricate links between our financial decisions and our emotional and spiritual health.

Discover this book on Amazon (affiliate link)

The Complete Cardinal Guide to Planning for and Living in Retirement

The financial complexities we face in retirement can be daunting. The landscape of Social Security, Medicare, insurance, benefits, investments, and planning for long-term care presents many choices, challenges, and opportunities. Retirement planning is a personal journey, and it's natural to feel overwhelmed by the numerous options available. Many of us dream of a peaceful retirement, but the uncertainty of how to manage our finances can creep in and spoil the experience. I recall a friend who, after decades of hard work, found himself struggling to make ends meet in his golden years. He felt frustrated, anxious, and unsure of how to navigate the complex web of retirement benefits and resources. That's when he stumbled upon a trusted advisor who helped him create a personalized plan. With the guidance of this advisor, he was able to make informed decisions and secure his financial future. This book offers a comprehensive guide to help readers like my friend take control of their retirement planning. It provides a clear and straightforward approach to understanding the major retirement options and explains simple yet effective strategies for creating a financially secure future. With the help of experts in the field and years of experience, the author shares practical advice and insights to empower readers to make informed decisions about their retirement. By taking a personalized and holistic approach to retirement planning, readers can unlock their financial potential and live a fulfilling retirement.

Discover this book on Amazon (affiliate link)

Hard Money: Financial Independence, Retire Early - join the FIRE movement igniting the world

Building wealth is not just about accumulating money, but about living a life that brings true freedom and fulfillment. It's about breaking free from the cycle of living paycheck to paycheck, where every month feels like a struggle to make ends meet. Everybody wants to achieve financial independence, to retire early and pursue their passions, but few people are willing to put in the effort to make it happen. It's not about buying expensive toys or keeping up with the latest trends; it's about making conscious choices about how we spend our money and our time. The author of this book shares practical strategies for saving money, avoiding common financial mistakes, and building wealth slowly and sustainably. Along the way, they reveal the surprising habits and mindsets of the wealthy and famous, who may not be as reckless with their money as we think. The book is not a get-rich-quick scheme, but a call to action for anyone who wants to take control of their financial future. It's about being willing to work while others sleep, learn while others party, and save while others spend - and then living a life that truly reflects our values and aspirations.

Discover this book on Amazon (affiliate link)

How to Make Your Money Last - Completely Updated for Planning Today: The Indispensable Retirement Guide

This book is a comprehensive guide to helping you make your money last throughout your retirement. The author provides simple and straightforward solutions to the universal problem of how to stretch limited savings to cover life's expenses. She covers a wide range of topics, including mortgages, social security, income investing, annuities, and more. The good news is that you don't have to figure everything out on your own - the author offers practical advice on how to get every dollar you're entitled to on social security, how to determine whether to take a lump sum or a lifetime monthly pension, and how to safely use your savings to raise your monthly income.

The author also shows you how to evaluate your real risks and make informed decisions about how to invest your money. She challenges traditional notions of "income investing" by combining reliable cash flow with low-risk growth investments, creating a customized approach that can help you turn your retirement funds into a steady income stream that will last for many years. As someone who has worked with many people who are nearing retirement, I know how stressful it can be to think about how to make your money last. But with this book, you can take a step back and start making informed decisions about your financial future. The author's approach is approachable and accessible, making it easy for anyone to understand and implement her strategies. With the right guidance, you can turn your retirement savings into a "homemade" paycheck that will provide peace of mind and financial security for years to come.

Discover this book on Amazon (affiliate link)

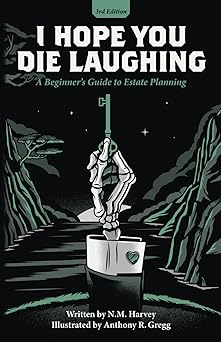

I Hope You Die Laughing: A Beginner's Guide to Estate Planning

This book is a refreshingly unique guide that tackles the often-dreary topic of estate planning with humor and wit. The author's tone is approachable and relatable, making it easy to imagine them sharing a laugh with you over a coffee cup. As I've navigated my own journey through the complexities of planning for the future, I've found myself wishing there was a more lighthearted approach to this often-overlooked aspect of life. This book delivers just that, demystifying the process and providing readers with a sense of control and empowerment. The author shares real-life anecdotes and practical advice, breaking down the often-daunting task of securing one's legacy into manageable, even enjoyable, steps. What I love most about this book is its emphasis on the importance of peace and clarity for loved ones left behind, and how this can be achieved through thoughtful planning and preparation. Through its engaging and non-judgmental tone, the book encourages readers to confront their own fears and limitations, and to take charge of their own final chapter with confidence and a sense of humor.

Discover this book on Amazon (affiliate link)