It feels like just yesterday my grandma was telling me stories about growing up in Birmingham, Alabama. She worked so hard her whole life, always putting her family first. I remember her worrying about having enough to make it through, especially as she got older. It wasn’t about wanting fancy things; it was about wanting to feel safe, knowing she could handle whatever life threw her way.

That feeling of security, that peace of mind, is what I want for everyone. Planning for retirement – for your family, your health, and your future – can feel overwhelming. It's easy to put it off, to think there's plenty of time. But even small steps taken now can make a huge difference down the road.

This isn't about getting rich. It's about feeling prepared. It’s about facing your worries head-on, whether they involve healthcare, a potential move to a nursing home, or simply feeling confident about your finances. The books I've gathered here are meant to be your friends on this journey – clear, straightforward guides to help you feel more in control and less anxious about what's ahead. Let's explore them together.

Save Your Money, Save Your Life: 110 Ways to Cut Spending and Reach Financial Freedom

This book is a must-read for anyone looking to break free from the cycle of overspending and living below their means. The author shares 110 practical and fun ways to cut expenses and save money, making it easy to get started on your own journey to financial freedom. Throughout the book, you'll find ideas on how to earn more, save on everyday expenses, and make the most of your hard-earned cash. The author also delves into the importance of saving and reducing expenses, sharing four powerful mental shifts that will change the way you think and act with your spending. One of the things that struck me, when I read this book, was how relatable the author's message is. I've been there myself, wondering how to save more and live a more fulfilling life without sacrificing my quality of life. I remember feeling overwhelmed by the idea of cutting expenses and didn't know where to start. But this book makes it feel achievable and manageable. The author's approach is down-to-earth and accessible, making it easy to understand and implement the ideas presented. What I love most about this book is its focus on empowering individuals to take control of their finances and live a more intentional life. By understanding the power of saving and reducing expenses, you'll be able to break free from the cycle of overspending and start living the life you want. With this book, you'll get inspired by new and creative ways to live lean and rich, without sacrificing your happiness or well-being. Whether you're looking to pay off debt, save for retirement, or simply feel more financially secure, this book has something to offer. The author's passion and enthusiasm for the topic are contagious, making it a joy to read and learn from.

Discover this book on Amazon (affiliate link)

Retirement Basics: Help for Broke Baby Boomers

This book is a comprehensive guide to help those approaching retirement years navigate the complex world of retirement planning with ease. The author's approach is down-to-earth and cheerful, making the subject matter accessible to a wide audience. The book covers a broad range of topics, including Social Security, Medicare, retirement planning, and healthy living, all presented in a simple and easy-to-understand manner. I can relate to the importance of being prepared for retirement, having experienced the challenges of planning for the future myself. It's reassuring to know that there are resources available to help, and this book is an excellent starting point for anyone looking to gain a better understanding of the retirement process. The author's warmth and humor shine through on every page, making the book a pleasure to read. With its practical and relevant approach, this book is a great asset for anyone looking to make the most of their retirement years.

Discover this book on Amazon (affiliate link)

Make Money Trading Leading Stocks: A Beginner's Guide to Free Trading Tools, Technical Analysis, Money and Risk Management, Trading Log for profits in ... Stock Market, Trend and Momentum Trading)

This book is a comprehensive guide for beginners who want to trade the stock market. The author, a seasoned trader with a Ph.D. in Civil Engineering, shares his knowledge and experience to help readers get started on their trading journey. What I find particularly inspiring about this book is the author's personal story - he spent 26 years working as an engineer before dedicating himself full-time to trading and writing about it. He wants to inspire and motivate high school and university students, as well as others who are new to trading, to take the leap and start their own journey. The book dives deep into various aspects of stock trading, such as using free tools and resources, identifying leading sectors and stocks, and determining optimal position sizes. The author also shares his expertise on relative strength and stock scanners, making the book a valuable resource for anyone looking to trade the stock market. What I love about this book is its accessibility - the author is transparent about the tools and resources he uses, and provides links to over 45 free websites. This makes it easy for beginners to access the information they need to get started.

Discover this book on Amazon (affiliate link)

Retirement Challenge, The: Will You Sink or Swim?: A Complete, Do-It-Yourself Toolkit to Navigate Your Financial Future

Imagine you're about to board a plane, but instead of flying, you're in charge of navigating your financial future. This is the reality for many Americans, who are struggling to manage their retirement portfolios. The problem is that most of us are just as qualified to manage our investments as we are to pilot a plane from Los Angeles to Boston. That's why Frank Armstrong's book, The Retirement Challenge: Will You Sink or Swim?, is like having a crash course in personal finance. With over 48 practical lessons, Armstrong shows you how to take control of your finances, assess what you have, and build a simple yet reliable retirement plan.

As I think about my own financial journey, I recall the feeling of being overwhelmed and unsure about where to start. It's like being lost in a maze, trying to find your way out. Armstrong's book breaks down the complex world of finance into easy-to-understand lessons, making it accessible to anyone who's looking to take charge of their financial future. One of the most impressive features of this book is its comprehensive online tools and resources, which include calculators, budget spreadsheets, and sample asset allocation plans. These tools will do all the math for you, making it easier to make informed decisions about your retirement portfolio.

The book is more than just a guide; it's a handbook for those planning for retirement. Armstrong and his co-author, Doss, don't just tell you how to build a plan; they also show you how to avoid falling prey to the wolves of Wall Street. With this book, you'll learn how to create a simple yet reliable plan that will help you outperform the vast majority of investors. If you care about the quality of the rest of your life, you owe it to yourself and your family to read this book.

Discover this book on Amazon (affiliate link)

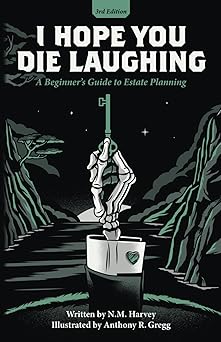

I Hope You Die Laughing: A Beginner's Guide to Estate Planning

This book is a unique and thoughtful approach to a topic that can be daunting for many people. The author's use of humor and wit makes the process of estate planning feel more approachable and less intimidating. I was struck by the author's ability to balance seriousness with levity, making the book an entertaining and engaging read. The writing is clear and concise, making it easy to follow along as the author walks readers through the process of securing their legacy and making informed decisions about their final arrangements. What I appreciated most about this book is the way it emphasizes the importance of peace of mind and the freedom to live life to the fullest, without the burden of uncertainty or worry about the future. The author's words are a gentle reminder that even in the darkest moments, there is room for joy and laughter, and that a well-planned farewell can be a source of comfort and closure for both the individual and their loved ones.

Discover this book on Amazon (affiliate link)