Planning for retirement can feel overwhelming, can’t it? I remember when my own parents started talking about it – the conversations were full of worry, complicated numbers, and a general sense of “what if?” It felt so distant then, something to deal with “later.” But later arrives faster than you think.

Here in Arizona, especially in Phoenix, we’re lucky to have sunshine and beautiful landscapes to enjoy our golden years. But a beautiful view is only part of a secure retirement. It’s about more than just the weather; it's about feeling safe, knowing your family is cared for, and having the peace of mind that comes with financial stability, even if unexpected things happen.

That’s why I’ve put together this list of books. These aren't dry financial textbooks. They are practical guides, filled with clear advice that anyone can understand, whether you’re just starting to save or already well on your way. We'll explore smart investing, protecting your assets, and even thinking about important things like health plans and what to consider when thinking about a nursing home. Let’s build a retirement that’s not just long, but truly fulfilling and secure – together.

The Bogleheads' Guide to Investing

The world of investing can be a complex and intimidating place, especially for those who are new to it. However, what if I told you that investing doesn't have to be a daunting task? This book, written by a community of experienced investors who follow the principles of John C. Bogle, offers a refreshing alternative to the typical "advice" you hear from Wall Street.

The book's authors are known for their straightforward and contrarian approach to investing, which may seem counterintuitive at first, but trust me, it's been proven to work over the years. They've taken the wisdom of John C. Bogle and distilled it down into a comprehensive guide that covers everything from creating a sound financial lifestyle to investing regularly and preserving your buying power. You'll learn how to craft your own investment strategy using the Bogle-proven methods that have worked for thousands of investors.

One of the most impressive things about this book is the community that's built around it. Over the past twenty years, the followers of John C. Bogle have grown from a loose association of investors to a major force in the financial world, with a non-commercial financial forum that's one of the largest on the internet. This book brings that same level of expertise and camaraderie to your doorstep, providing expert guidance, sound advice, and a healthy dose of humor along the way. You'll learn how to identify and throw out the "good" advice that's been perpetuated by Wall Street, and how to create a personalized investment plan that's tailored to your individual needs and goals.

Discover this book on Amazon (affiliate link)

Killing the Market: Legendary Investor Robert W. Wilson

Robert W. Wilson is one of the most successful investors in history, but not in the way you might think. He didn't start with a lot of money, just $15,000 from his mother in 1958. Despite that, he went on to grow his stake to an astonishing $230 million by 1986, a return of over 1,500% in just a few decades. But what's truly remarkable is what he did next. Wilson, who had once been known as a brilliant and prolific investor, began to lose his touch and stepped back from the investing business. In fact, he retired in 1986, feeling like he had "lost his touch." But instead of slowing down, he found a new passion in philanthropy, and an incredible opportunity to make a real difference in the world. Over the course of his life, Wilson amassed an enormous wealth of $800 million, but instead of indulging in personal projects or charity work that entertained him, he focused on giving away millions of dollars to genuine charities striving to make the world a better place for all of us. His generosity was truly remarkable, with over $700 million of his wealth given away by the time of his passing in 2013. What's most inspiring about Wilson's story is the way he was able to transform his incredible success into a force for good, and the lessons we can learn from his approach to achieving greatness, both in business and in life.

Discover this book on Amazon (affiliate link)

Live Off Dividends: Achieving Financial Freedom: The Dividend Growth Blueprint

Imagine you're living off dividends, achieving financial freedom. It's a dream many of us have, and it's not just a fantasy. With the right strategy and knowledge, you can make it a reality. This book is a comprehensive guide to growing your wealth through dividend investing, perfect for beginners and experienced investors alike.

Growing dividends is a way to achieve financial freedom, where you don't have to trade your precious time for money. This book is designed to be your practical and easy-to-follow guide, with all the information you need to start your journey. Inside, you'll discover the basics of dividends and learn how to calculate them, identify the best dividend-paying stocks, and understand Ex-Dividend Dates, Dividend Payout Ratios, and when the Dividend is paid.

You'll also learn about Blue Chip Stocks with Dividends, Stocks with Dividend Growth Potential, and how to analyze dividend stocks with real-life examples. You'll find the best dividend stocks for long-term investments and learn how much you need to invest to live off dividends. Additionally, you'll get a deep understanding of dividend stock analysis and find ETFs with high dividend yields.

With this book, you'll be able to focus on long-term investing, choose the best dividend stocks yourself, optimize your portfolio return, and take smart investing decisions. Whether you're a beginner or an experienced investor, this book is an essential resource for anyone who wants to grow their wealth through dividend investing. It's a step-by-step blueprint for building a successful dividend portfolio. This book is a must-read for anyone looking to take control of their financial future and live off their investment income.

Discover this book on Amazon (affiliate link)

The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work, and Living

This book provides a straightforward and accessible guide to overcoming the challenges of retirement security in the post-crash economy. Many baby boomers who are facing the wake-up call of not having saved enough for retirement are being encouraged to think about how many post-work years they need to finance their living expenses. The author tackles the tough questions about retirement, such as insuring against the risk of outliving one's assets and managing healthcare expenses in retirement. By providing detailed advice on how to boost lifetime income, hire a financial advisor, and rethink housing, this guide aims to help readers create a truly fulfilling and secure retirement. The author also discusses the importance of career reinvention, the 50+ job market, and midlife entrepreneurship, offering strategies for workers who are 50 years old and up. The book provides a practical and engaging solution for those navigating the retirement landscape, providing the tools needed to make the most of the years leading up to and including retirement.

Discover this book on Amazon (affiliate link)

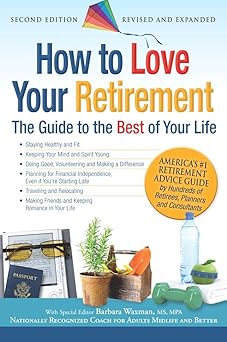

How to Love Your Retirement: The Guide to the Best of Your Life (Hundreds of Heads Survival Guides)

For many of us, the thought of retirement can be both exciting and intimidating. As I've seen in the hundreds of retirees I've had the privilege of meeting and hearing from, the key to making the most of this stage of life is to approach it with an open mind, a positive attitude, and a willingness to learn and adapt. One of the most important things to remember is that retirement is not just about the absence of work, but about the presence of purpose and fulfillment. I've seen firsthand the joy and satisfaction that can come from pursuing hobbies, spending time with loved ones, and giving back to the community. For example, I've met someone who retired at 60 and spent the next decade traveling the world, learning new languages, and volunteering in projects that brought her closer to her passions. I've also seen how learning new skills, such as art, music, or cooking, can bring a sense of excitement and renewal to life. These are just a few examples of how it's possible to create a fulfilling and meaningful life in retirement. With the right mindset and support, it's possible to transform this stage of life into a time of joy, growth, and connection.

Discover this book on Amazon (affiliate link)