Sometimes, I think back to my grandmother, Maybelle. She lived right here in Montgomery her whole life, and she always worried. Not about big things, necessarily, but about the little things – could she afford the medicine, would the roof leak, would her children be okay? Retirement, she thought, should be a time of peace, but she carried those worries with her, even as she enjoyed her garden and her family.

That image of Maybelle, and the longing for a truly peaceful retirement, is what inspired this list. We all want to enjoy this chapter of our lives, to relax and feel secure. But sometimes, those feelings of security seem just out of reach. Maybe it’s concerns about money, navigating family dynamics, or even just figuring out how to best care for our health as we age – especially in a place like Alabama where options and resources can feel complicated.

This isn't a list of complicated finance books or scary medical guides. These are stories and simple tools to help you feel more in control, more prepared, and ultimately, more at peace. Think of it as a gentle hand guiding you toward a retirement filled with joy, connection, and a little less worry – just like Maybelle deserved.

The 9 Steps to Financial Freedom: Practical and Spiritual Steps So You Can Stop Worrying

This book is about taking control of your finances and finding true freedom. The author, Suze Orman, has a way of explaining complex concepts in a way that's easy to understand, and she shares her own personal experiences and insights to make the book relatable and engaging. One of the things that I found particularly helpful was the way she talks about how our past experiences and emotions can hold us back from achieving financial freedom. She encourages us to face our fears and create new truths about ourselves and our money, and to trust ourselves more than we trust others. I also appreciated her emphasis on the importance of being open to receiving all that we are meant to have, rather than just focusing on what we don't have. Throughout the book, Suze Orman shares practical advice and real-life examples, as well as inspiring stories of people who have overcome their financial struggles and found true freedom. She's not just a financial expert, but also a compassionate and empathetic guide who wants to help you break through all the barriers that hold you back. By following her 9 steps, you'll gain the knowledge and motivation to take control of your finances and start living a life that truly reflects your values and worth.

Discover this book on Amazon (affiliate link)

Retirement

Planning your retirement can be a daunting task, but what if it's also an exciting opportunity to create a life of purpose and fulfillment? As I reflect on my own experiences, I recall the conversations I've had with friends and family who are nearing retirement, and the uncertainty that often accompanies this life-changing event. But what if this transition wasn't just about slowing down, but about stepping into a new chapter of your life where you can pursue your passions and make a meaningful impact? This book offers a refreshing perspective on retirement planning, one that focuses on creativity, productivity, and helping others. The author empowers you to take control of your calendar, filling it with activities that bring you joy and a sense of satisfaction. By focusing on your strengths and abilities, you'll be able to create a life of purpose and significance, one that goes beyond mere survival. The book encourages you to think about retirement as an adventure, not a destination, and to see it as a chance to explore new interests, travel, and connect with others. With its emphasis on empowerment and personal growth, this book is a must-read for anyone approaching this pivotal stage of life.

Discover this book on Amazon (affiliate link)

Buy and Hope: How I Beat the Pros, Doubled the Nasdaq, Spending ONLY 1 Minute A Week

This book is about a simple yet effective way to invest in the stock market, which has helped its author, Randall Mauro, achieve financial freedom. Mauro, the chief investment officer at Resnn Investments, was once frustrated with the traditional investing strategies that were not working for him, and he set out to find a better way. After years of research and testing, he developed a strategy that involves spending only 1 minute a week, which has resulted in significant gains and kept his money safe during market downturns.

Mauro shares his strategy, called Protective Investing, which is based on a technique that has been backed by over 40 years of performance data. He dispels common myths about investing and challenges the conventional wisdom that has been taught to many investors. He also shares personal anecdotes and insights from his own experiences as an investor. Mauro's approach is centered around taking control of one's investments and avoiding the risks associated with the market.

One of the most striking aspects of Mauro's strategy is its simplicity and effectiveness. He uses the example of the 2008 market crash, where a 45% loss was reported, compared to a 4.5% loss for those who followed his strategy. This raises a powerful question: how much better off would you be if you had made different investment decisions? Mauro's strategy offers a way to achieve significant gains with lower risk and no real time commitment required, simply by spending 1 minute a week on investing. By learning from Mauro's approach, investors can say goodbye to the old way of thinking and hello to a more reliable and effective way of managing their portfolios.

Discover this book on Amazon (affiliate link)

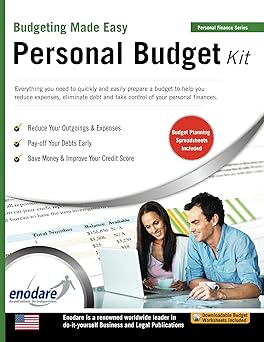

Personal Budget Kit

Living with a personal budget is not just about cutting back on expenses, but about creating a foundation for a better life. I remember when I was in my early twenties and was struggling to manage my finances. I had high bills, no savings, and was living paycheck to paycheck. It felt like I was drowning in a sea of debt and uncertainty. But after discovering the power of budgeting, everything changed for me. I learned how to analyze my income and expenses, set realistic goals, and make smart financial decisions. It wasn't easy, but with the right tools and mindset, I was able to gain control over my finances and start building a brighter future. This Personal Budget Kit is designed to do the same for you. It provides step-by-step instructions, detailed information, and all the necessary budget worksheets and spreadsheets to help you identify and understand your spending habits, reduce your expenses, set goals, prepare personal budgets, monitor your progress, and take control over your finances. With this kit, you'll be able to reduce your spending, pay off debts early, improve your credit rating, save and invest money, set and achieve financial goals, and eliminate financial worries.

Discover this book on Amazon (affiliate link)

Effortless Savings: A Money Management Guide to Saving Without Sacrifice

This book is a very helpful guide for anyone looking to save money without having to make too many sacrifices. The author realizes that many people want to save money but are unwilling to give up their favorite things, such as dining out or traveling. The book offers a simple and practical game plan that can help readers achieve substantial savings. The strategies covered in the book are for all income levels and household sizes, making it accessible to everyone. From grocery shopping to banking and credit card techniques, the book provides easy and painless methods to reduce bills and save money on everyday expenses. The author also shares effective tips on how to save on shopping, entertainment, vacations, and auto maintenance. These tips can help readers save thousands of dollars.

Discover this book on Amazon (affiliate link)