Sometimes, I look around at my Little Rock book club and see so many familiar faces, folks who’s spent decades working hard, raising families, and building lives right here in Arkansas. And I know, because I’ve seen it myself with my own mama, that retirement isn’t always the peaceful ending we picture. It can be a time of big questions – about money, about health, about finding purpose when the routine of work disappears.

I remember sitting with my mama after she retired, and she just looked…lost. She’s always been a doer, a giver, and suddenly she felt like she had nothing to give. It broke my heart. That’s why I put together this list of books. They aren’t about complicated financial terms or scary legal documents. They’re about finding joy, security, and a renewed sense of purpose, whether you’re just starting to think about retirement or already navigating those waters. They’re about making sure your golden years truly sparkle, and that you feel empowered to face whatever comes your way, right here in Arkansas.

Retirement Reboot: Commonsense Financial Strategies for Getting Back on Track

Millions of Americans have been hit hard by the COVID-19 pandemic, and for those nearing retirement age, the financial impact has been devastating. Before the pandemic, many households over 50 were already struggling to make ends meet in retirement. But with the pandemic, those numbers are sure to worsen. That's why finance writer Mark Miller is here to help. In his book, Miller offers practical strategies for Americans to improve their retirement prospects. He starts by walking readers through the core decisions they need to make now to improve their retirement outcomes. This includes making a plan, thinking through the timing of retirement, optimizing Social Security, navigating Medicare, building savings, and tapping home equity. Miller also explores ongoing strategies like careful budgeting, generating income from work even after retirement, planning for long-term care, and accessing special assistance aimed at low-income workers. If you're worried you haven't saved enough for retirement, or if you have low savings or none at all, Miller's simple steps can help you make the most of your remaining working years and reboot the retirement you always imagined. With his guidance, you can take control of your financial future and create a brighter, more secure retirement.

Discover this book on Amazon (affiliate link)

The Joy of Retirement: Finding Happiness, Freedom, and the Life You've Always Wanted

I must say, I've always been fascinated by the prospect of living life on one's own terms, free from the constraints of a 9-to-5 job. As someone who's had the privilege of meeting and hearing from people who have made this transition, I can attest to the transformative power of embracing a fulfilling retirement. The book I'd like to share with you explores the idea that retirement isn't just about stopping work, but about rebirth - a chance to rediscover ourselves, pursue our passions, and create a life that truly reflects our values. The author shares inspiring stories and practical advice on how to make the most of this new chapter, from finding new interests that tap into our unique talents to establishing priorities and criteria for success. What I find particularly empowering about this book is its emphasis on vitality, joy, and meaning in our lives - it's a clarion call to not just accept, but to actively create the life we desire. By shedding the notion that retirement means settling for a life of quiet desperation, this book offers a beacon of hope and possibility, reminding us that we have the power to craft a future that's vibrant, purposeful, and truly fulfilling.

Discover this book on Amazon (affiliate link)

The New Retirement Savings Time Bomb: How to Take Financial Control, Avoid Unnecessary Taxes, and Combat the Latest Threats to Your Retirement Savings

This book is a must-read for anyone who has saved money for retirement. Many of us diligently save for years, but often don't realize the mistakes we're making that could be costing us a significant portion of our hard-earned savings to taxes. The author, a renowned tax advisor, shares a clear and easy-to-follow plan to take control of our retirement savings plan. The book explains how to avoid the latest traps set out by Congress and other pitfalls that could deplete our assets before we even have the chance to use them. What I found particularly helpful was how straightforward the author makes complex financial concepts, explaining everything in simple terms that can be easily understood by anyone, regardless of their background or financial knowledge. The author's passion to help people protect their retirement savings is truly inspiring and relatable. I think it's essential for anyone who has savings and investments to listen to this book, whether it's five years or 50 years away from retirement. The book is like having a trusted financial advisor guiding you through the process, offering expert advice on how to make the most of your retirement savings. With this book, you'll learn how to place your assets to avoid unnecessary taxes and keep your hard-earned money safe, no matter what the future holds.

Discover this book on Amazon (affiliate link)

Unretirement: How Baby Boomers are Changing the Way We Think About Work, Community, and the Good Life

The idea of retirement as a static, definitive phase of life is a relic of the past. For decades, we've been conditioned to believe that once we hit a certain age, we must withdraw from the workforce and devote our time to leisure and luxury. But what if this narrative is not only outdated but also unsustainable? Award-winning journalist Chris Farrell makes the compelling case that we're on the cusp of a profound transformation, one that's being driven by the baby boomer generation. For too long, demographers have warned that an influx of aging baby boomers would bankrupt Social Security and Medicare, depleting the system's reserves and leaving a trail of economic devastation in its wake. Yet, Farrell argues, the opposite is occurring. Instead of withering away, boomers are finding new purpose and meaning in their lives, extending their working years and pursuing careers, entrepreneurial ventures, and volunteer service with renewed passion and energy. The result is a seismic shift in the American economy and society, one that's redefining what it means to be "retired" and what it means to contribute to the workforce. As we navigate this uncharted territory, Farrell's book offers a comprehensive guide, drawing on his years of experience covering personal finance and economics. With its practical advice and insights, this book is an essential resource for boomers poised to embark on this exciting new chapter, as well as anyone interested in understanding the implications of this seismic shift.

Discover this book on Amazon (affiliate link)

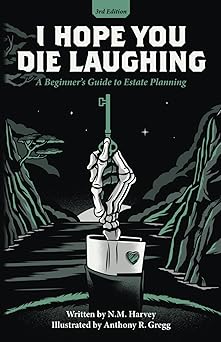

I Hope You Die Laughing: A Beginner's Guide to Estate Planning

This book is a unique and refreshing guide to estate planning, presented in a way that's both humorous and compassionate. The author invites readers to think about the end of their life in a way that's relaxing and enjoyable, rather than daunting and scary. I know how important it is to feel secure about the future, especially when it comes to the people we love. I remember when my grandmother passed away, it was a difficult time for my family, and we were all unsure about what to do next. But with some guidance and support, we were able to navigate the process with more confidence and peace of mind. This book offers a similar sense of reassurance, making what is often considered a morbid topic feel more approachable and manageable. The author takes the time to explain complex legal concepts in a clear and straightforward way, all while injecting a sense of humor and levity that makes the process feel more like a conversation with a trusted friend. By the end of the book, readers will have a solid understanding of how to secure their legacy, make informed decisions, and leave their loved ones with clear and stress-free plans.

Discover this book on Amazon (affiliate link)