Sometimes, I look around at my own family and see the worries etched on their faces. My aunt, living in Tucson, was talking about her health plan the other day – a complicated mess of paperwork and confusing options. My cousin, just a few years from retirement, fretted about whether he’s saved enough. It’s a familiar story, isn’t it? Especially here in Arizona, where so many of us are looking forward to that well-deserved time of rest and relaxation.

But what does "retirement" really mean? Is it just about putting your feet up and enjoying the sunshine? Or is it about navigating a new set of challenges – health concerns, financial security, and the shifting dynamics within our families? I've seen firsthand how easily these things can overshadow the joy we expect retirement to bring.

That’s why I put together this list. These aren’t just books; they’re guides, companions, and conversation starters. They tackle everything from making sure your money lasts to rethinking what "work" even means. Whether you're planning for retirement, already enjoying it, or just want to be prepared, I hope you’ll find something here that resonates with you and helps your family navigate this important chapter with confidence and peace of mind.

Retire Secure!: For Same-Sex Couples

This book has been a game-changer for me when it comes to financial planning, especially for those in the LGBTQ+ community. I remember when my sister first got married to her partner, I wanted to make sure they were as financially secure as possible. I had to do some research on my own and was relieved to find this book. The story of the two gay couples who had identical financial resources but took different approaches to retirement planning really resonated with me. The first couple, who never got married, started social security at 62, didn't make any Roth IRA conversions, and didn't use key IRA and retirement plan estate planning strategies, ran out of money in just 28 years. Meanwhile, the second couple, who did get married, used strategies like applying and suspending social security, did a series of Roth IRA conversions, and used key IRA and retirement plan estate planning strategies, ended up with $1.4 million dollars and their portfolio continued to increase. It's clear that the key to their financial success was planning and using the right strategies. This book provides a comprehensive guide to retirement planning for same-sex couples, covering topics like social security, Roth IRA conversions, IRA planning, and more. It's a must-read for anyone in the LGBTQ+ community who wants to ensure they're financially secure in retirement.

Discover this book on Amazon (affiliate link)

The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich (Expanded and Updated)

This book is a game-changer for anyone feeling trapped in a 9-to-5 job and yearning for a better life. The author presents a bold idea that you don't have to wait until retirement to escape the daily grind and live the life you've always dreamed of. In fact, with the right mindset and strategies, you can break free from the constraints of a traditional work-life balance and join the ranks of the "new rich." The book is filled with practical tips and real-life examples from people who have successfully implemented this lifestyle, including how to double your income, overcome common obstacles, and reinvent yourself. You'll also learn how to eliminate distractions like email, negotiate with your boss and clients, and apply lifestyle principles even in uncertain economic times. The author shares the latest tools and tricks to help you live like a diplomat or millionaire, without the hefty price tag. What I love about this book is how it challenges traditional notions of success and retirement, and instead offers a flexible and empowering approach to living life on your own terms.

Discover this book on Amazon (affiliate link)

The Money Class: Learn to Create Your New American Dream

As I reflect on the transformative power of personal finance, I am reminded of the countless individuals I've met who have struggled to overcome financial fears and doubts. That's why I'm so passionate about sharing the wisdom of a renowned expert in the field. In nine engaging classes, Suze Orman guides readers on a journey of empowerment, teaching us how to navigate the complexities of modern finance and reclaim our financial security. Suze's approach is rooted in her own experiences of overcoming financial adversity and finding the courage to stand in her truth. She shares practical tools and advice on how to tackle pressing issues such as real estate, career development, and retirement planning, all while prioritizing the well-being of our families and homes. With her trademark directness, Suze cuts through the noise and gets straight to the heart of the matter, offering a comprehensive strategy that's attainable for everyone, regardless of age or financial situation. As we explore the world of personal finance, Suze reminds us that financial security is not just about avoiding mistakes, but about cultivating hope and trust in our ability to create the life we desire. By the end of this journey, readers will be equipped with the knowledge and confidence to take control of their financial future and feel hopeful once again about the possibilities that lie ahead.

Discover this book on Amazon (affiliate link)

The Big Retirement Risk: Running Out of Money Before You Run Out of Time

This book is a comprehensive guide to managing wealth in retirement, providing readers with the strategies they need to live the life they've always envisioned without worrying about running out of money. With decades of experience as a financial consultant, Erin Botsford is well-positioned to share her expertise with readers, offering a refreshing perspective on traditional methods of asset allocation. By focusing on the philosophy that money allows choices, Botsford encourages readers to become informed and wise investors, avoiding common pitfalls and challenging the status quo. She understands that many members of the Baby-Boom generation may have lost assets during the financial crisis and is dedicated to helping them restore confidence in their financial outlook. The book tackles common concerns such as ensuring enough money for a lifetime, considering the impact on spouse and children, and navigating Social Security and Medicare. Botsford also provides in-depth analyses of market patterns and offers practical explanations of investment strategies, empowering readers to adopt a new philosophy about their finances and retirement planning. By taking control of their financial future, readers can protect their hard-earned money and live the life they deserve, free from the fear of running out of money before they run out of time.

Discover this book on Amazon (affiliate link)

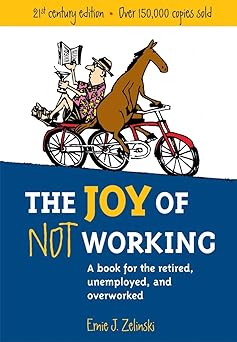

The Joy of Not Working: A Book for the Retired, Unemployed and Overworked- 21st Century Edition

Living life to the fullest, without the burden of a 9-to-5 job, is a concept that can be both daunting and liberating. Ernie Zelinski, a renowned expert in this field, has spent years helping over 300,000 people discover the joy of embracing life's different stages. What's most fascinating is how this individual has managed to break free from the conventional norms and find happiness in every aspect of life. He's succeeded in finding a balance between work and play, employment and retirement, that's not only sustainable but also fulfilling. Through his book, we're given a comprehensive guide on how to do the same. We're shown how to be more productive, pursue our passions, and live life to the fullest. We're encouraged to take the leap and leave a job that's draining our energy, and instead, find activities that make a real difference in our well-being. The book is filled with eye-opening exercises, inspiring letters from readers, and thought-provoking diagrams that make it easy to understand and apply. It's a book that will challenge our perceptions, spark our imagination, and leave us with a renewed sense of purpose. As we delve into the world of The Joy of Not Working, we're reminded that it's never too late to make a change and start living the life we truly desire.

Discover this book on Amazon (affiliate link)