Sometimes, I think back to when my own parents started talking about retirement. It wasn’t a joyful conversation. There were worries about money, about health, about being a burden on us, their children. I remember the feeling of helplessness, wanting to fix everything but not knowing where to start. It was a difficult time, and it made me realize how important it is to be prepared, not just financially, but emotionally and practically, for this next chapter.

Moving to Arizona for retirement – the sunshine, the beautiful scenery, the slower pace – it sounds idyllic, doesn’t it? But a dream location doesn’t automatically solve everything. It’s easy to get caught up in the excitement of a new place and forget to think about the really important stuff: your finances, your health, and how to navigate the complexities of aging with grace and peace of mind.

That’s why I’ve put together this curated list of books. These aren’t just about numbers and plans; they're about building a foundation of confidence and clarity so you can truly enjoy your retirement years, whether you've lived in Arizona your whole life or are just starting to explore what it has to offer. They're about making informed decisions, protecting your loved ones, and feeling secure about the future – for yourself and for your family. Let's dive in.

The Total Money Makeover: A Proven Plan for Financial Fitness

This book is a powerful guide to breaking free from the cycle of debt and achieving financial stability. The author's story is one of transformation, from being a slave to debt to becoming a master of his finances. He shares his own journey, along with the stories of others who have successfully turned their financial lives around. What I love about this book is its honesty and vulnerability. The author is not afraid to share his own weaknesses and mistakes, and instead of offering a formulaic solution, he provides a practical and straightforward approach to getting out of debt. He debunks the myths and illusions that often hold us back, and instead, focuses on the real issue: our own relationship with money. He reminds us that we are the ones responsible for our financial woes, and that it's our choices that can either lead us down the path of financial freedom or further into debt. The author's clear and concise writing style makes this book accessible to everyone, regardless of their financial situation. What struck me most was the author's emphasis on hope and empowerment. He doesn't just offer solutions, but also provides a sense of possibility and promise. He tells us that we can break free from the cycle of debt and achieve financial fitness, and that it's never too late to make a change. The book is not just a guide, but a call to action, urging us to take control of our finances and start building a better future for ourselves.

Discover this book on Amazon (affiliate link)

The Only Investment Guide You'll Ever Need: Revised Edition

This book is like having a trusted friend who's always ready to offer words of wisdom on managing your finances. The author, Andrew Tobias, shares a wealth of knowledge and experience gathered from years of helping people navigate the complex world of investing. He begins by explaining the importance of setting a good foundation, such as building an emergency fund, creating a budget, and developing a long-term plan. Tobias also emphasizes the need to be patient and disciplined when it comes to investing, highlighting the benefits of starting early and being consistent. The book covers a wide range of topics, including investing in different asset classes, understanding fees and expenses, and preparing for retirement. What I find particularly impressive is how Tobias tackles the complexities of modern investing, including cryptocurrency, NFTs, and the impact of climate change on our financial decisions. He does this in a clear and accessible way, making it easy for readers to understand and implement his strategies. Throughout the book, Tobias shares engaging anecdotes and real-life examples that illustrate the importance of making informed financial decisions. Overall, this book is a valuable resource for anyone looking to take control of their finances and build a secure financial future.

Discover this book on Amazon (affiliate link)

In God We Trust: Morally Responsible Investing

This book is a thought-provoking exploration of the intersection of economics, morality, and personal responsibility. It delves into the complexities of current economic developments and their implications on society, particularly among long-term investors. The author reflects on the resurgence of U.S. prosperity in 2018, which can be attributed to pro-growth policies such as tax rate cuts and deregulation. Interestingly, this growth has led to a growing sentiment in favor of socialism, particularly among young people and leftist politicians. The book offers a nuanced examination of the divide between capitalism and socialism, highlighting the economic and moral ramifications of each. By drawing on historical precedent, the author convincingly argues that socialism has never been successful anywhere in the world, as eloquently stated by President Ronald Reagan. The book serves as a guide for individuals seeking to invest in the capital markets while avoiding businesses with which they disagree morally. Through the lens of his own experience as a portfolio manager and founder of Ave Maria Mutual Funds, the author shares his perspective on the importance of incorporating moral responsibility into investment decisions. The book has resonated with many investors, who have entrusted over $2.2 billion to five award-winning mutual funds. As someone who has witnessed the impact of investing on personal values, I can appreciate the value of this book in providing a framework for making informed, principled investment choices.

Discover this book on Amazon (affiliate link)

The Annuity Stanifesto

As I sat down to read this book, I couldn't help but think of my grandfather who passed away a few years ago, and how much he relied on his annuity to support himself in his retirement. Finding a book that could explain the complex world of annuities in a way that was easy to understand was a challenge I was eager to tackle. This book delivers on that promise, providing a comprehensive overview of every type of annuity and explaining annuity strategies from simple to complex. The author's no-nonsense approach makes the book feel approachable and accessible, even for those who may not have a background in finance. What I appreciated most about the book was its emphasis on providing unique insight into the annuity industry, highlighting the essential specifics that should be understood within every policy. As I turned the pages, I felt like I was getting a true understanding of how annuities work in your portfolio, and that's exactly what I was looking for. The author's passion for the subject shines through on every page, making this book a valuable resource for anyone looking to gain a deeper understanding of annuities.

Discover this book on Amazon (affiliate link)

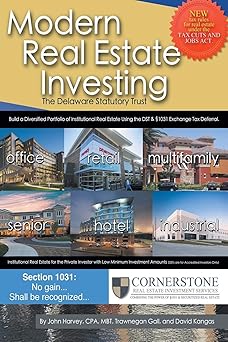

Modern Real Estate Investing: The Delaware Statutory Trust

This book is a game-changer for anyone looking to invest in real estate. The author, a seasoned expert in the field, introduces the concept of the Delaware Statutory Trust (DST) which allows individual investors to access institutional-grade properties that were previously out of reach. Imagine being able to diversify your portfolio with properties worth millions, without having to break the bank. The DST is a ingenious way to do just that, offering protection under securities regulations and the ability to enjoy tax benefits like non-recognition of gains through IRC section 1031 exchanges. The author doesn't just introduce the concept, but also guides you through the entire investment process, from choosing the right brokers and sponsors to analyzing the DST offering. What I love about this book is how it explains complex concepts in a clear and concise manner, making it accessible to anyone, regardless of their background or experience. The author also provides real-life examples of how the DST has helped smaller investors achieve financial freedom, and offers valuable advice on how to avoid common mistakes. One of the most impressive things about this book is how it tackles the Trump tax plan and its impact on the DST structure, providing a comprehensive understanding of how it can benefit your investments. I've seen firsthand how investing in real estate can change people's lives, and this book has the potential to be a life-changer for many readers.

Discover this book on Amazon (affiliate link)