It's really common to feel uneasy or worried about money, isn's it? I remember when I was younger, I felt like I should always be saving, and it was a constant source of stress. It felt like I was doing something wrong if I spent money on anything I enjoyed. But then I realized, a lot of us women have been taught to think about money in a very limited way. We're told to be careful with our spending, while men are often encouraged to learn about investing and building wealth. This isn't our fault, it’s a result of the way we’re raised and the messages we receive about money. When big changes happen, like a job loss, women are often the first to be affected and the last to recover. This creates a real barrier to equality, and it’s no wonder so many of us feel anxious when it comes to finances. But what if we could change that? What if money wasn't about restriction, but about making choices that bring us joy and allow us to live the lives we want?

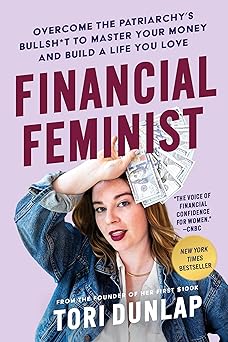

This book is a guide to doing just that. It’s about breaking free from those old messages and taking control of your financial future. It teaches you how to deal with debt, figure out what’s truly important to spend money on, and how to save without feeling deprived. It even covers investing, so you can build wealth and eventually retire comfortably. The author created a community called Her First $100K to help women learn these skills in a safe, supportive environment, free from judgment or shame. The book shares the lessons learned from that community, and provides practical exercises to help you understand your own relationship with money. You'll find prompts to guide you in setting financial goals and discover simple steps to achieve them. The book takes a deeper look at some of the hidden parts of the financial world, from how credit card companies operate to the reasons behind the racial wealth gap. It also explores how you can use your money to support causes you believe in.

Ultimately, this book is about empowering you to make your money work for you, rather than the other way around. It’s about creating a life where you have the freedom to travel, pursue your passions, and give back to the world. It’s a reminder that you deserve to feel confident and in control of your finances, and that building wealth isn’t just for some people—it’s for everyone. It encourages you to challenge the traditional views of money, to understand your values, and to make informed decisions that align with your goals. It’s a journey of self-discovery and financial empowerment, and it's a roadmap to a more fulfilling and secure future.

It’s something I’m sure many of us can relate to – that feeling of being a little lost when it comes to money. I remember my mom always telling me to be careful, to save every penny. It wasn’t meant to be a criticism, of course, it was her way of protecting me. But as I got older, I realized that this carefulness had instilled in me a quiet worry, a sense that I was somehow doing something wrong by enjoying life's little pleasures. It’s easy to feel that way, especially as women. We’re often given these messages about money, to be cautious and frugal, while men are encouraged to learn about investing and building their wealth. It’s not that it’s anyone’s fault, it’s just the way things have been, and it can be hard to break free from those deeply ingrained habits. I’m not a financial expert, but I'm someone who understands what it feels like to struggle with that inner voice that tells you you're not doing enough. It’s a feeling that affects so many of us, and it can be so isolating. It’s amazing how much that feeling can hold you back from truly living the life you want, and it’s a constant battle to overcome it. I have seen firsthand how these messages can impact women, especially when unexpected events happen, and it’s a significant barrier to achieving true equality.

This guide offers a fresh perspective on that struggle. It’s not about complicated strategies or becoming a financial wizard. It’s about changing the way you think about money. It's about understanding where those feelings of worry and guilt come from, and then learning to let them go. You’re guided to get a better understanding of your debts, and learn how to decide where your money is best spent. It explores investing, and offers tools to help you save without feeling like you are depriving yourself. The author built a space where women could learn these skills together, a place where there’s no judgment and everyone feels safe. That community’s lessons are shared here, along with exercises to help you figure out your own personal relationship with money. There are exercises to help you set your own goals, and discover simple ways to work towards them. The guide delves deeper into how credit cards work, and explains the reasons behind the differences in wealth between different groups of people. It even encourages you to consider how your money can be used to support causes you care about.

What makes this book so special is that it’s about more than just numbers and spreadsheets. It's about freedom and confidence. It's about taking control of your financial future and creating a life that is truly aligned with your values. It’s about recognizing that you deserve to feel secure and empowered when it comes to your money. Building wealth isn't something only some people get to do—it’s something everyone can achieve, and it's a journey of self-discovery that will help you live a more meaningful and fulfilling life. It's a roadmap to a brighter future where you can travel, pursue your passions, and make a positive impact on the world, all while feeling completely in control of your financial well-being.

Rating: 5.0 / 5.0

It’s really comforting to read something that understands the worry many of us feel about money. It's common to feel stressed about finances, and this book gently acknowledges that feeling without judgment. It helps you understand where those anxieties come from, especially for women who have often been taught to be careful with money while men are encouraged to learn about investing. It’s not about complicated financial strategies; instead, it's about changing how you think about money and finding a way to feel more in control. This book provides practical steps to deal with debt, save money without feeling restricted, and even learn about investing. It feels like a warm, supportive friend guiding you towards a more confident and secure future, and I think it's something many of us need right now.