Sometimes, I think back to my grandma, bless her heart. She worked so hard her whole life, always putting everyone else first. When she finally reached retirement, she worried more about how to help her children and grandchildren than about enjoying her own golden years. It broke my heart to see her so stressed. That’s why I started this book club – to help folks in Fayetteville, and beyond, feel more secure about their futures, both for themselves and for their families. Planning for retirement and protecting your loved ones can feel overwhelming. There’s so much information out there, and it’s easy to feel lost. This isn't about getting rich; it’s about peace of mind – knowing you’ve done what you can to prepare for whatever life throws your way, from a comfortable retirement to ensuring your family is taken care of. This curated list is a starting point, a friendly hand to guide you through some important topics.

Saving for Retirement without Living Like a Pauper or Winning the Lottery: Retirement Planning Made Easy

This book is a straightforward guide for anyone looking to save for retirement. Gail MarksJarvis, a personal finance expert, explains that saving for retirement shouldn't have to be complicated. She breaks down the process into simple steps that can be followed by anyone, regardless of their financial knowledge or experience. What's more, Mark Jarvis shares her own favorite strategies for saving and investing, which she's learned from her years of listening to readers and addressing their concerns.

What's perhaps most impressive about this book is its accessibility. MarksJarvis eliminates technical jargon and simplifies investing techniques, making it easy for readers to understand their options and make informed decisions. She also shares practical advice on how to avoid debt, find reliable financial help, and navigate the stock market without taking unnecessary risks. One of the most appealing aspects of this book is its emphasis on the importance of starting early, even if it feels daunting. By breaking down the process into manageable steps and providing clear guidance, MarksJarvis empowers readers to take control of their financial future.

This book is often praised for its clear and concise approach to personal finance and retirement planning. Marks Jarvis' experience as a columnist, where she's answered questions from over 20,000 readers, has given her a deep understanding of the issues that concern people most. She shares this expertise in a way that's approachable, relatable, and – most importantly – actionable. By the end of the book, readers will have a solid understanding of how to save for retirement without falling into the trap of get-rich-quick schemes or unnecessary financial complexity.

Discover this book on Amazon (affiliate link)

Retire Secure!: A Guide To Getting The Most Out Of What You've Got, Third Edition

This comprehensive guide offers a straightforward approach to maximizing the benefits of IRAs and retirement assets. It addresses the fear of running out of money, which is a major concern for many readers nearing retirement. The book provides valuable recommendations for saving tens of thousands to over one million dollars by paying taxes later. It also offers strategies for preparing for the "death" of the stretch IRA, converting to Roth IRAs, and understanding the rules of Roth 401(k) and Roth 403(b) plans. Additionally, it discusses the benefits of second-to-die life insurance and a definitive estate plan that has been featured in major financial journals. The author's expertise in this area is evident in the glowing endorsements from financial experts and authors, including Charles Schwab, Larry King, and Ed Slott. This guide is perfect for consumers who want a straightforward approach to retirement planning, as well as for financial experts who need detailed information on accumulation and distribution strategies. By following the author's advice, readers can create a secure retirement and ensure they can enjoy their golden years without financial worries.

Discover this book on Amazon (affiliate link)

IRAs, 401(k)s & Other Retirement Plans: Strategies for Taking Your Money Out

This book is a must-read for anyone who is nearing retirement or has recently inherited a retirement plan. The author takes a compassionate approach to explain the complex rules surrounding retirement plans, making it easy to understand for those who may feel overwhelmed by the process. I recall a friend who inherited a retirement plan from her late husband, and was unsure of how to proceed. After reading this book, she felt empowered to make informed decisions about her nest egg, avoiding stiff taxes and penalties that could have drained her savings. The book covers a range of topics, including tax strategies before and after retirement, required distributions, penalties for taking money out early, and what happens to your retirement plan after your death. The author also delves into the specifics of dividing a plan at divorce and navigating inherited plans. With its 16th edition, this book stays up-to-date with the latest changes, including new start ages for required distributions and updated contribution limits. By providing clear guidance and practical advice, this book helps readers save their nest egg from the IRS and enjoy a more secure retirement.

Discover this book on Amazon (affiliate link)

The Annuity Stanifesto

This book is a game-changer for anyone looking to fully comprehend the intricacies of annuities. Written by Stan, a renowned expert in the field, it's a straightforward and no-nonsense guide that strips away the jargon and gets straight to the point. Stan shares his extensive knowledge of annuities, taking readers on a journey from the basics to the most complex strategies. What I admire most about this book is its ability to demystify a subject often shrouded in complexity. Stan's writing style is approachable and easy to follow, making it possible for readers with little to no prior knowledge to grasp the concepts. What strikes me as particularly insightful is how Stan reveals the inner workings of annuities in relation to a portfolio, providing essential information that can be applied to any policy. Throughout the book, Stan's unique approach shines through, leaving readers with a solid foundation for understanding the intricacies of annuities. Stan's passion for explaining the subject in an accessible way shines through in every line, making this book a trusted resource for anyone seeking a deeper understanding of the annuity industry.

Discover this book on Amazon (affiliate link)

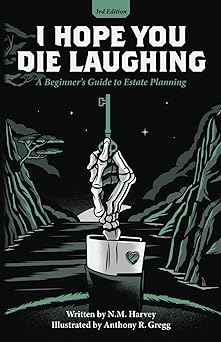

I Hope You Die Laughing: A Beginner's Guide to Estate Planning

As I reflect on the importance of estate planning, I am reminded of the many people I've met who have struggled with the idea of preparing for the end of life. They often see it as a morbid or daunting task, something that's better left to others. But what if I told you that it's not only possible to make estate planning a more enjoyable experience, but also a necessary one? This book, a guide for those just starting out, takes a refreshing approach to the subject. It's written with humor and empathy, acknowledging that the conversation around death and legacy can be uncomfortable. The author's goal is to empower readers to take control of their own affairs, without feeling overwhelmed or burdened. With this book, you'll learn how to secure your assets, make informed decisions, and leave a lasting legacy that brings peace of mind to your loved ones. The author's writing style is approachable and relatable, making it easy to imagine a conversation over coffee, rather than a formal lecture. As you turn the pages, you'll discover that estate planning isn't just about preparing for the end of life, but also about living a more intentional, stress-free life - a life where you can rest easy, knowing that you've left a lasting mark on the world.

Discover this book on Amazon (affiliate link)