It feels unsettling, doesn't it? Like the ground beneath our feet isn’t quite solid. We hear whispers of economic downturns, recessions, and financial instability, and it’s easy to feel anxious, overwhelmed, and maybe even a little helpless. I remember a few years ago, watching my neighbor struggle to keep his small business afloat during a particularly rough patch. The worry etched on his face, the uncertainty in his voice – it stayed with me. It reminded me that economic hardship isn't just numbers and graphs; it’s real people, real families, facing real challenges.

That’s why I’m putting together this curated list of books. These aren’t easy reads, but they are essential. They don’t offer simple solutions or promises of quick fixes. Instead, they offer understanding. They delve into the complexities of our economy, explore the factors that lead to downturns, and offer insights into how we can navigate these turbulent times. My hope is that by understanding what’s happening, and why, we can feel a little less helpless, a little more prepared, and a little more empowered to face whatever the future holds.

All the Devils Are Here: The Hidden History of the Financial Crisis

The financial crisis of 2008 was a complex and multifaceted event that shook the world economy to its core. As I reflect on the journey that led to this catastrophic event, I am reminded of the many voices that contributed to the chaos, each with their own motivations and agendas. One of the most compelling books I've had the pleasure of reading on this subject is a masterful examination of the crisis from multiple angles. The author weaves a rich tapestry of stories, highlighting the roles of powerful CEOs, politicians, regulators, and ordinary citizens in shaping the crisis. What struck me most about this book is its nuanced portrayal of human nature, revealing how our deepest desires and flaws can often lead us down a path of destruction. The book delves into the mythology of homeownership, exposing the unrealistic expectations and false promises that fueled the housing bubble. By exploring the motivations of both the big players and the anonymous lenders and borrowers, the author sheds light on the intricate web of causes that ultimately led to the crisis. With its meticulous research and thought-provoking insights, this book challenges readers to rethink their assumptions about the crisis and its causes, inviting us to consider the complex interplay of factors that contributed to one of the most significant economic events of our time.

Discover this book on Amazon (affiliate link)

Freefall: America, Free Markets, and the Sinking of the World Economy

The recent financial crisis has left an indelible mark on the world, impacting more people than any crisis since the Great Depression. I still remember the anxiety and uncertainty that gripped my family and friends as the economic downturn took hold. We had to make tough decisions, like reducing our expenses, cutting back on non-essential items, and wondering if our financial security would ever be restored. The crisis was not just a matter of economic woes, but also a reflection of flawed government policies, unscrupulous personal and corporate behavior, and the failures of capitalism. The question on everyone's mind was, "What went wrong?" Joseph E. Stiglitz, a renowned economist and Nobel Prize winner, sets out to answer this question in his book, offering a lucid account of the crisis and its impact. He argues that the system is broken and that we can only fix it by examining the underlying theories that led us into this predicament. Stiglitz contends that a restoration of the balance between government and markets is necessary to prevent similar crises in the future. He also addresses pressing issues like healthcare, energy, the environment, education, and manufacturing, providing a clear and compelling vision for a prosperous economy and a moral society. The book is a call to action, urging us to rethink our economic systems and to work towards a more equitable and sustainable future. As I read through Stiglitz's words, I couldn't help but feel a sense of hope and renewed purpose, knowing that we have the power to shape a better world for ourselves and our children.

Discover this book on Amazon (affiliate link)

How Markets Fail

Many people struggle with financial insecurity, feeling like they're not getting ahead despite working hard. I recall a friend who lost their job due to corporate restructuring, which left them feeling defeated and uncertain about their future. This feeling is far more common than we think, and it's often the result of a flawed economic system. In fact, economist John Cassidy argues that the way our markets work can sometimes lead to disaster, such as stock market bubbles, extreme inequality, and environmental degradation. For decades, economists have developed theories about how markets function, with the idea being that they can efficiently allocate resources and create wealth. However, when the market fails, it can have devastating consequences. Cassidy's book, How Markets Fail, explores this idea in depth, exploring the concept of "utopian economies" that ignore the complexities of human behavior. He draws on his own reporting and explains complex economic theories in a clear and accessible way, warning that blindly following old economic orthodoxies can be downright dangerous. The updated edition of the book highlights how the lessons of the 2008 financial crisis remain unheeded, and the urgent need for a new approach to economic thinking.

Discover this book on Amazon (affiliate link)

The Great Recession

This book is a thought-provoking analysis of the 2008-9 global financial crisis, which was one of the worst economic downturns in modern history. The author draws heavily from Karl Marx's theories on the laws of motion in a capitalist economy to explain why this crisis occurred. The author explains that the crisis was not just a result of bad luck or poor management, but rather a natural consequence of the inherent flaws in the capitalist economic system. The author also explores the role of financial speculation, deregulation, and the concentration of wealth in the hands of a few individuals, which he believes contributed to the crisis. What struck me about this book is how eerily relevant it feels to the current state of our economy. I couldn't help but think of the parallels between the 2008 crisis and the rising inequality and economic instability we're seeing today. The author's arguments are not only insightful, but also provocative, and I found myself wondering if he's right - could this crisis happen again? The author's analysis is thorough and well-researched, making this book a valuable resource for anyone interested in understanding the underlying causes of economic crises.

Discover this book on Amazon (affiliate link)

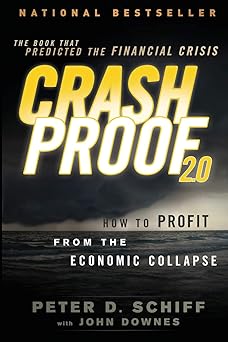

Crash Proof 2.0: How to Profit From the Economic Collapse

The economic storm that we're facing today is a harsh reminder of the warnings that have been sounded for years. A decade ago, seasoned prognosticator Peter Schiff predicted the very market mayhem that we're witnessing now, and he's offering a timely guide to help us navigate this treacherous terrain. Crash Proof 2.0 is more than just a survival guide - it's a blueprint for financial stability in the face of growing debt, too little savings, and a declining dollar. As someone who has seen the devastating effects of financial crises firsthand, I can attest to the importance of having a solid plan in place. Peter Schiff's insights and expert advice are rooted in his years of experience helping clients restructure their portfolios, and his three-step plan offers a clear path forward in these uncertain times. Throughout the book, Schiff explains the structural weaknesses underlying the economic meltdown and provides practical measures to protect yourself and profit from the current downturn. He offers a nuanced examination of the factors that will affect our financial stability and provides a roadmap for preserving wealth and protecting the purchasing power of our savings. What I find particularly striking about this book is its ability to break down complex economic concepts into accessible language, making it a valuable resource for anyone looking to make sense of the chaos that surrounds us.

Discover this book on Amazon (affiliate link)