I look back at my own journey and realize how much I wish I’d had a little more guidance, a little more clarity, when I was first starting to think about retirement. It wasn't about having a huge pile of money; it was about feeling prepared, feeling like I understood the choices ahead of me, and knowing I could still enjoy life to the fullest. I remember feeling a bit lost, wondering about health plans, feeling anxious about family, and just wanting to make sure I wasn’t missing something important.

That’s why I put together this list – to be that little bit of guidance for you. This isn’t about complicated rules or confusing jargon. It's about feeling confident as you navigate this exciting new chapter, whether you’re settled in Mesa, dreaming of Arizona sunsets, or just starting to plan. These books tackle everything from making smart choices about your finances to finding joy and connection in your days, ensuring that your retirement is filled with family, fun, and a whole lot of peace of mind. Let's explore these together!

The Annuity Stanifesto

This book is a game changer for anyone looking to make sense of the complex world of annuities. Stan's no-nonsense approach makes complex concepts easily digestible, and his enthusiasm for sharing his knowledge is infectious. I still remember when I first started learning about annuities, I felt like I was drowning in a sea of unfamiliar terms and jargon. But this book was like a lifeline, helping me to grasp the basics and understand how annuities work in my portfolio. Stan breaks down every type of annuity, from the simplest to the most complex, and provides unique insights into the annuity industry. He explains the essential specifics of each policy in a way that's both clear and concise, making it easy to understand where and how annuities fit into your overall financial strategy. What I love most about this book is that it's not just a dry, technical guide - it's a comprehensive resource that will help you make informed decisions about your financial future. With its unique blend of accessibility and expertise, this book has become a go-to resource for anyone looking to navigate the world of annuities.

Discover this book on Amazon (affiliate link)

Receiving Financial Blessing

This book has been a game-changer for me, having experienced financial struggles in the past. I remember feeling like I was stuck, not knowing how to manage my finances or make sense of God's plan for my money. As I began to read this book, I felt a sense of comfort and reassurance, knowing that I was not alone in my struggles. The author, Stephen Kirkendall, has dedicated his career to helping Christians make sense of their finances, and it shows in the depth and wisdom of this book. Kirkendall digs deep into the Bible, exploring the concept of financial blessings and how they apply to everyday life. He makes complex financial concepts accessible and relatable, using real-life examples and anecdotes to illustrate his points. Throughout the book, Kirkendall emphasizes the importance of living a life of honesty and integrity when it comes to money, and how this can bring about true financial freedom. What struck me most about this book is its emphasis on the need for Christians to give Jesus what is "necessary" in order to receive the blessings He intends for His followers. It's a powerful reminder that our finances are not just about making ends meet, but about worshiping and honoring God.

Discover this book on Amazon (affiliate link)

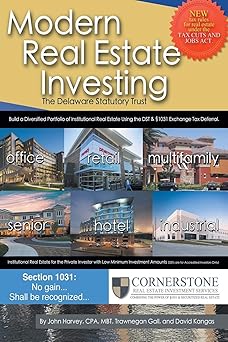

Modern Real Estate Investing: The Delaware Statutory Trust

This book is a game-changer for anyone interested in real estate investing. I remember when I first read about the Delaware Statutory Trust (DST), I was amazed at how it can provide a way for small investors to get into institutional-grade properties that would otherwise be out of reach. The author, John Harvey, does an excellent job of explaining the basics of DSTs, from the securities regulations to the tax benefits, in a way that's easy to understand. I was particularly impressed by the way the book breaks down the investment process, from choosing a broker to analyzing the DST offering. Harvey also provides clear examples of how DSTs can help reduce risk in tax exchanges, which is a huge advantage for investors. What I love most about this book is that it's not just about the numbers; it's about how to build a diversified portfolio that can help you achieve your financial goals. I've had the chance to meet Kosmas G. Toskos, a DST investor, and he can attest to the book's value in providing practical advice on navigating the 1031 exchange. One thing that really stood out to me was the author's expertise on the Trump tax plan and how it affects DST structures. This book is a must-read for anyone looking to get into real estate investing, especially those who are just starting out. It's a comprehensive resource that will provide you with a solid foundation to build on.

Discover this book on Amazon (affiliate link)

Don't Retire... Graduate!: Building a Path to Financial Freedom and Retirement at Any Age

Life is full of twists and turns, and when it comes to planning for retirement, it's normal to feel overwhelmed. As someone who has worked with numerous individuals to find their path to financial freedom, I can attest to the fact that it's never too late to start. The key is to take control of your finances and make informed decisions that will help you achieve your goals. With the right guidance, anyone can graduate into a successful retirement. This book, filled with updated strategies and expert advice, is the perfect resource for anyone looking to build a path to financial freedom. By learning how to invest, manage risk, and navigate complex financial situations, you'll be able to create a security net that will protect you and your loved ones. The author's straightforward approach makes it easy to understand, even for those who may not have a background in finance. The book is divided into comprehensive sections that tackle everything from avoiding costly mistakes to maximizing your peak earning years. With its extensive coverage of topics such as retirement accounts, IRAs, and risk management, this guide is a must-read for anyone looking to turn their financial challenges into opportunities. Whether you're just starting out or have years of experience under your belt, this book will provide you with the knowledge and confidence you need to achieve a secure and fulfilling retirement.

Discover this book on Amazon (affiliate link)

The Complete Ultimate Book of Fun Things to Do in Retirement: Volume 1 & 2 (Ultimate Retirement Series)

Retirement can be a challenging time for many, as it can bring feelings of boredom, loneliness, or lack of purpose. But what if we told you that inspiration for your dream retirement was just a click away? The key to turning ordinary golden years into extraordinary ones lies in sparking your imagination and exploring new avenues. This book is all about embracing your sense of adventure, trying new things, and finding joy in unexpected places.

Imagine waking up each morning excited for the day ahead, with a sense of purpose and direction that fills you with joy. You spend your days engaging in activities you love, connecting with others who share your passions, and feeling truly alive in a way you may not have experienced in years. The best part? This new chapter of your life is entirely within your control. You can shape your retirement in any way you see fit to create a life that is uniquely yours and reflects your values, interests, and passions.

Inside this jam-packed book, you'll find hundreds of ideas to spark your imagination for planning an exciting, active, happy, healthy, and mentally sharp life after work. You'll discover travel and adventure inspiration to ignite your wanderlust, outdoor activities for staying healthy and active, and social opportunities to make new friends. You'll also find exciting new hobbies, useful technology to thrive in retirement, and practical advice on topics such as cruising and photography. Additionally, you'll find a wealth of helpful website resources, suggested books, valuable tips, and simple steps to get started on your new interests.

What's more, you'll receive two free bonuses: a 61-page PDF on travel planning and a senior's guide to ChatGPT. Perhaps most importantly, this book is designed to inspire you to live your best retirement life. You'll find guidance on approaching retirement with a positive mindset and embracing this new chapter of your life with enthusiasm and purpose. Whether you're looking for tips on travel, hobbies, or social activities, you'll find a wealth of practical advice and inspiring ideas for every interest and mobility level.

Discover this book on Amazon (affiliate link)