I was working hard, sure, but I felt so lost when it came to money. It felt like everyone else had a secret I hadn't been told. I was constantly worried about bills, felt guilty about small pleasures, and honestly, just felt…stuck. It wasn’t about not having enough; it was about not understanding how to make what I had work for me.

That feeling – that sense of being adrift when it comes to your finances – is something I’m convinced so many of us share. It’s why I put together this list. These aren't complicated finance textbooks. These are stories, lessons, and straightforward advice that helped me start to feel more in control, more hopeful, and more secure about my future. They’re about more than just numbers; they’re about mindset, habits, and ultimately, building a life where you feel free and empowered. Let’s dive in together and start building that future, one page at a time.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

This thought-provoking book is a fascinating exploration of the human mindset when it comes to money. The author, Morgan Housel, shares 19 short stories that demonstrate how our thoughts, emotions, and behaviors shape our financial decisions. What struck me most about this book was how it challenged my own perspective on money and investing. The author highlights how our "personal history" and "unique view of the world" influences our financial choices, often in unexpected ways. I particularly appreciated how the author emphasizes that doing well with money isn't just about having a lot of knowledge, but about how we behave. The book also explores how our emotions, such as pride and ego, can sometimes lead to poor financial decisions. As someone who has experienced the importance of making smart financial choices firsthand, I found this book to be both eye-opening and reassuring. The author's writing style is engaging and accessible, making it easy to understand complex concepts without feeling overwhelmed. What I loved most about this book was the way it made me realize that making better sense of money and wealth is not just about accumulating wealth, but about living a life that aligns with our values and goals.

Discover this book on Amazon (affiliate link)

Rich AF: The Winning Money Mindset That Will Change Your Life

I recently finished reading a book that really resonated with me, and I just have to share its message with all of you. The author, Vivian Tu, is a TikTok star who was once like many of us, clueless about personal finance. But then she found a mentor on Wall Street who taught her the secrets to financial success. Vivian's story is inspiring because she went from not knowing anything about money to becoming a financial expert. Now, she's sharing her knowledge with the world, and it's incredibly valuable. Vivian's book is all about breaking down complex financial concepts into simple, easy-to-understand advice. She offers practical tips on how to earn more, save smartly, invest wisely, and overcome financial fears. She also shares her own experiences and insights, making the book feel like a personal conversation with your favorite friend. What I love most about this book is that it's not just about wealth and money; it's about building a mindset that will help you achieve your financial goals and live a more fulfilling life. Vivian's approach is refreshing and empowering, and I couldn't help but feel motivated and inspired as I read through her pages. I think many people will find her advice and insights helpful, regardless of their background or financial situation. Vivian's passion and expertise shine through on every page, making this book a must-read for anyone looking to improve their financial literacy and start building a more secure financial future.

Discover this book on Amazon (affiliate link)

The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life

I recently had the pleasure of reading a book that has truly opened my eyes to the world of personal finance. The author, in a series of letters to their daughter, shared their journey of learning about money and investing in an approach that is both accessible and effective. It's a powerful truth that money is the single most powerful tool we have for navigating our complex world, and yet, many of us leave it unattended, leaving ourselves vulnerable to those who seek to profit from our lack of understanding.

The book takes a refreshing approach to the often overwhelming world of investing, breaking down complex concepts into simple, easy-to-understand language. It's a stark contrast to the often convoluted and profit-driven advice that's out there, which is designed to confuse and part us from our hard-earned money. Instead, the author shares practical strategies for building wealth, including how to avoid debt, how to think about money in a unique way, and how to invest in a raging bull or bear market. The book also delves into the mysteries of the stock market, the importance of having "fat" money, and how to simplify the often-confusing world of retirement accounts.

What struck me most about this book is its emphasis on financial independence and how it can be achieved through a simple, yet powerful approach. The author shares their own journey of learning about money and investing, and how it has allowed them to build a life of financial freedom. The book is not just about investing; it's about creating a life that is rich, free, and fulfilling. The author's passion and enthusiasm for this subject are infectious, and I found myself eager to learn and implement the strategies and principles outlined in the book.

Discover this book on Amazon (affiliate link)

Broke Millennial: Stop Scraping By and Get Your Financial Life Together (Broke Millennial Series)

This book is a game-changer for anyone struggling to manage their finances. As I've seen with many of my friends and family members, taking control of your money can be overwhelming, but it doesn't have to be. The author, Erin Lowry, shares her own personal experiences and anecdotes to make the topic more relatable and less intimidating. She begins by walking readers through the simplest steps of getting their financial life together, like understanding their relationship with money and setting a budget. What sets this book apart from others in the genre is its willingness to tackle the tough stuff, like dealing with student loans, navigating relationships with partners, and figuring out how to split bills without breaking the bank. Lowry's approach is refreshingly straightforward and easy to understand, making it accessible to readers who may feel like they're already drowning in financial jargon. Throughout the book, she shares hilarious and heartwarming stories that illustrate the challenges and triumphs that many of us face when it comes to money. The result is a roadmap for becoming a money master, filled with practical advice and a healthy dose of humor. Whether you're just starting to think about your financial future or you're already a pro at managing your cash, this book is a must-read for anyone looking to take control of their financial life.

Discover this book on Amazon (affiliate link)

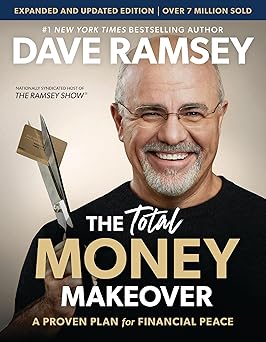

The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace

This book is more than just a financial guide - it's a way to transform your relationship with money and find peace in your finances. I've seen firsthand how difficult it can be to break free from the cycle of debt and financial stress, but this book offers a simple and straightforward solution. The author, a well-known personal finance expert, shares practical strategies and real-life stories to help you develop healthy financial habits. He starts by helping you design a plan to pay off all debt, one step at a time, using a method called the debt snowball. But it's not just about getting rid of debt - it's about creating a budget that actually works for you and your lifestyle. The book also tackles common money myths and offers encouragement to make lasting changes. One of the things that resonates with me is the idea of "living like no one else, so later like no one else." It's a reminder that financial freedom is not just about accumulating wealth, but about living a life that is true to who you are. The author's approach is not about quick fixes or get-rich-quick schemes, but about making sustainable changes that will have a lasting impact on your finances. By the end of this book, you'll have the tools and the confidence to take control of your finances and start building a brighter future.

Discover this book on Amazon (affiliate link)