In the heart of Maryland, a hospital stood as a symbol of America's troubled history with segregation and racial inequality. In March 1911, a group of 12 Black men were brought to the hospital, forced to work in the forest to build its foundations. These men, who would become the first patients at the Hospital for the Negro Insane, were subjected to harsh conditions and treatment, their lives forever changed by the experience. For centuries, their stories have been absent from our history books, hidden behind the brick walls of Crownsville Hospital.

As we delve into the history of Crownsville Hospital, we find a story of madness, segregation, and the struggle for dignity. The hospital, which operated from 1911 to 1990, was a microcosm of America's evolving battles over slavery, racial integration, and civil rights. Patients were subjected to inhumane treatment, including forced labor, physical restraints, and emotional abuse. The hospital's wards were overcrowded, with almost 2,700 patients at their peak, and the institution became a symbol of the dehumanizing effects of segregation. Yet, amidst the darkness, we find stories of resilience, survival, and resistance. Patients and employees alike shared their intimate tales of struggle, hope, and redemption.

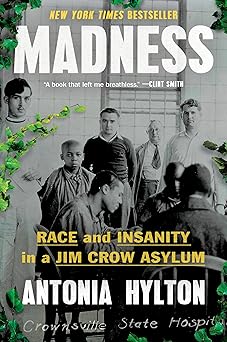

The story of Crownsville Hospital is a powerful meditation on the legacy of slavery and its impact on our current mental healthcare system. Investigative journalist Antonia Hylton weaves together the stories of patients, employees, and her own family's experiences with mental illness to create a narrative that is both captivating and heartbreaking. By shedding light on a chapter of America's history that has been hidden for so long, Hylton invites us to confront the dehumanizing effects of segregation and the importance of dignity and care for all individuals. Through her book, Madness, we are reminded of the power of storytelling to heal, to educate, and to transform.

I recently had the opportunity to dive into the powerful story of a hospital that was once a symbol of America's troubled history with segregation and racial inequality. As I read through the pages of this book, I couldn't help but be reminded of the struggles that many of us have faced in our own lives, often without even realizing the impact that we've had on others. The hospital's dark past is a sobering reminder of the dangers of dehumanizing others, and it's a testament to the strength and resilience of the individuals who were affected by it.

The hospital's story is one of tragedy, but also of hope and redemption. It's a story about the human spirit, and the ways in which we can find the strength to carry on even in the darkest of times. I was struck by the sheer number of people who were affected by the hospital's policies and practices, and the ways in which they were treated as nothing more than numbers rather than human beings. It's a tragedy that many of us can still relate to today, and it's a powerful reminder of the need for compassion and understanding in our own lives. As I read through the pages of this book, I couldn't help but think of my own family's history and the ways in which our experiences have shaped me. I know that I'm not alone in feeling this way, and I hope that this book will bring comfort and healing to those who have been affected by similar experiences.

The author's approach to storytelling is one of great sensitivity and empathy, and it's clear that she has a deep understanding of the complexity of the issues she's tackling. By sharing the stories of patients, employees, and her own family, she creates a narrative that is both deeply personal and universally relatable. As I closed the book, I felt a sense of hope and renewal, and I knew that I would be thinking about this story for a long time to come. It's a book that will stay with me, and I have no doubt that it will do the same for many others.

Rating: 3.0 / 5.0

I recently had the opportunity to dive into the powerful story of a hospital that was once a symbol of America's troubled history with segregation and racial inequality. The hospital's dark past is a sobering reminder of the dangers of dehumanizing others, but it's also a story of hope and redemption. The author's approach to storytelling is one of great sensitivity and empathy, and she weaves together a narrative that is both deeply personal and universally relatable.

I was struck by the sheer number of people who were affected by the hospital's policies and practices, and the ways in which they were treated as nothing more than numbers rather than human beings. The hospital's story is a tragedy, but it's also a testament to the human spirit and its ability to find strength in the darkest of times. The author's book is a powerful meditation on the legacy of slavery and its impact on our current mental healthcare system, and it will stay with me for a long time to come.

I highly recommend this book to anyone who is looking for a story that is both heartbreaking and uplifting. It's a reminder of the power of storytelling to heal, to educate, and to transform.