Sometimes, I look back at my twenties and think, “If only I’d known then what I know now!” It wasn’t about needing more money, though that’s always helpful. It was about feeling prepared. I remember the worry, the feeling of being adrift when it came to my future, especially when I started thinking about retirement. It felt like a distant, complicated puzzle I didn't even know where to start piecing together.

That feeling, that desire to feel secure and in control of your future, is something I’ve seen echoed in so many of the people I’ve connected with over the years. And that's why I’ve put together this collection of books. It's not about becoming a financial expert. It’s about feeling empowered, having a roadmap, and finding a little more peace of mind as you plan for the next chapter of your life. These books are a starting point – a friendly guide to help you unlock your dream retirement and build a future filled with freedom and joy.

The Bogleheads' Guide to Investing

This book is a comprehensive guide to investing, written by a group of enthusiasts who have been following the investment philosophy of John C. Bogle for many years. They have created a DIY handbook that shares their knowledge and experience, offering contrarian advice that has helped thousands of investors achieve success. The book is filled with witty and humorous anecdotes, making it an enjoyable read that is also informative. The authors share their insights on how to create a sound financial lifestyle, diversify a portfolio, start early, invest regularly, and preserve buying power. They also provide guidance on how to navigate the complexities of financial markets, where one's gain often comes at another's loss. What sets this book apart is its focus on simple yet effective investment strategies that have been proven to work over time. With its comprehensive guidance and expert advice, this book is a must-read for anyone looking to take control of their financial future.

Discover this book on Amazon (affiliate link)

DREAM BIG [Hardcover] Mukesh Jindal

![DREAM BIG [Hardcover] Mukesh Jindal](/post/unlock-your-dream-retirement-essential-reading-for-financial-freedom-and-peace-of-mind/images/image_71YipCX8afL._SY342_.jpg)

I recently had the pleasure of organizing a book club around a thought-provoking title that explored themes of hope, resilience, and the power of the human spirit. The story revolves around the life of a young girl who faces numerous challenges and setbacks, but never loses sight of her dreams. Through her journey, we witness the transformation of a young girl into a strong and determined individual who refuses to give up on her aspirations. As I reflect on my own life experiences, I can relate to the author's message of perseverance and the importance of chasing one's passions, regardless of the obstacles that come our way. The writing style is engaging, and the narrative is both heart-wrenching and uplifting, making it a truly unforgettable read. The author's use of vivid imagery and descriptive language brings the characters and their world to life, immersing the reader in a story that is both deeply moving and inspiring.

Discover this book on Amazon (affiliate link)

Buy and Hope: How I Beat the Pros, Doubled the Nasdaq, Spending ONLY 1 Minute A Week

Imagine you're sitting in front of your TV watching the stock market fluctuate. You're anxious about what's going to happen next and fear that your investments will be affected. You've been trying different strategies but still feel uncertain and stressed about your financial future.

This book is about a man who, after feeling frustrated and helpless, discovered a simple yet effective way to protect his investments and achieve financial freedom. He learned that spending only 1 minute a week can be enough to make a big difference. This approach, based on Protective Investing, has been proven to work over 40 years and has helped him quit his day job at the age of 38.

The author shares his personal story and insights, dispelling common myths about traditional investing and showing how a new approach can be more effective. He explains how diversification, dollar cost averaging, and other popular strategies no longer work to protect your investments. Instead, he offers a proven technique that can help you take control of your finances and make better decisions.

You might wonder what would have happened if you had made different decisions in the past, like avoiding major losses or recovering from a market downturn. This book is about learning from the past and finding a better way forward. The author shares real-life examples of how some investors lost big and never recovered, while others achieved success with a simpler approach.

The author's goal is to provide a solution for ordinary investors who want to make a difference in their financial lives. He wants to help you break free from the cycle of buying and holding, and instead, make informed decisions that can bring you financial freedom. With this approach, you'll never feel helpless when the market fluctuates, and you'll have the tools to take control of your investments.

Discover this book on Amazon (affiliate link)

Receiving Financial Blessing

We've all been there - struggling to make ends meet, wondering where our money is going, and feeling like we're missing out on God's blessings. For Stephen Kirkendall, a trusted guide on financial matters for Christians, this was a familiar feeling. He knew that many of his followers were not receiving the financial blessings that come with trusting in Jesus. So, he decided to take a closer look at the Bible's teachings on money and finances. Through a thorough study, he discovered that many Christians are not being financially blessed because they're not giving Jesus what He needs. This is a crucial realization: when we're not living out the truth of our faith in our financial lives, we're actually blocking ourselves from receiving the blessings that God wants to give us. This comprehensive book is the result of Kirkendall's research, and it's a must-read for every believer. It's a book that will challenge your understanding of tithing and its relevance to our lives today, and provide you with the tools and wisdom you need to walk in truth, righteousness, and honesty with your money.

Discover this book on Amazon (affiliate link)

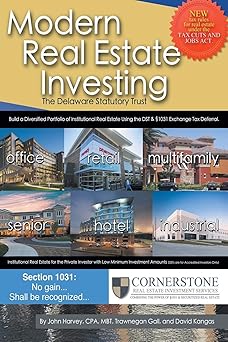

Modern Real Estate Investing: The Delaware Statutory Trust

This book takes readers on a journey to explore a new concept in real estate investing, the Delaware Statutory Trust (DST). It's a synthesis of 100 years of real estate, securities, and tax laws that provide a unique investment entity, allowing modern real estate investors to build a diversified portfolio under protective securities regulations. The book not only introduces the DST but also guides the reader through the investment process, offering valuable insights into choosing the right brokers, sponsors, and properties, and analyzing the DST offering. What's particularly exciting is that this concept provides opportunities for smaller investors to access institutional properties that were previously out of reach due to large equity requirements and financing constraints. The book explains how DSTs can help balance risk in 1031 exchanges, a process that allows investors to defer taxes on gains from the sale of investment properties. The author also expertly explains the impact of the Trump tax plan on DST structures and highlights the tax savings of 1031 exchanges. Furthermore, the book offers practical examples of dos and don'ts in 1031 exchanges, making it a comprehensive resource for those looking to get started in modern real estate investing. Throughout the book, the author shares real-world experiences and perspectives from experienced investors, making the complex concepts more accessible and relatable. By the end of the book, readers will have a clear understanding of how DSTs can be a valuable tool for building a diversified real estate portfolio and achieving long-term financial success.

Discover this book on Amazon (affiliate link)